Janet Yellen thinks the US Dollar is a ““cash is not a convenient store of value.”

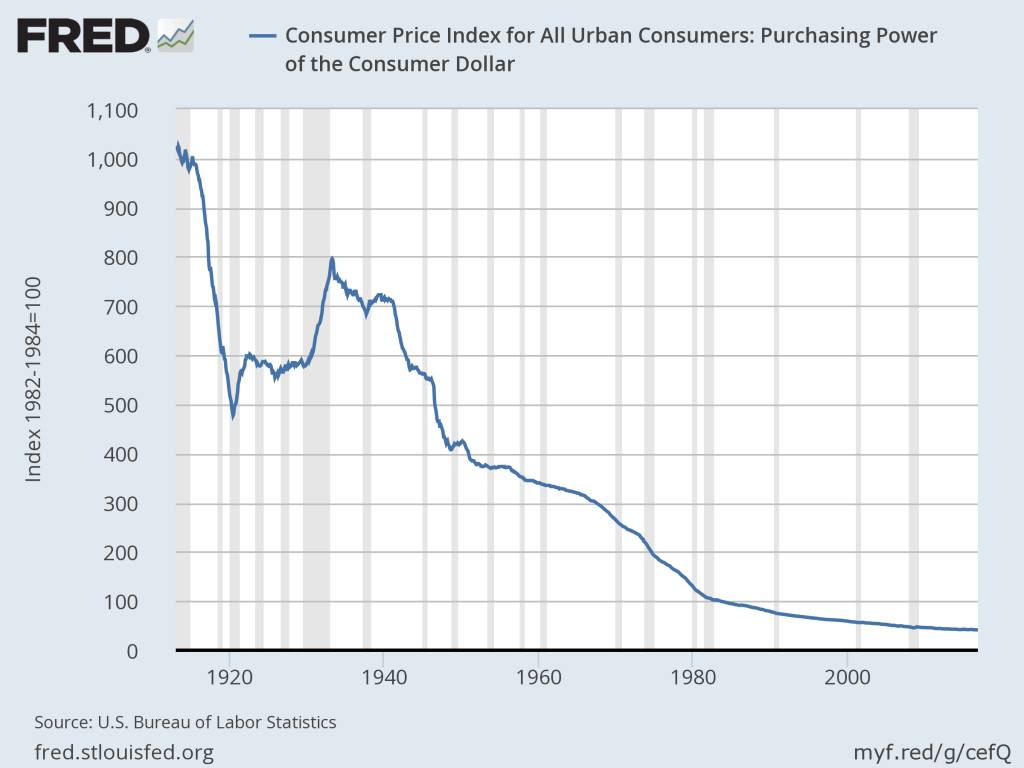

Long-term she is correct. After all, thanks to the Fed, the $USD has lost 95% of its purchasing power over the last 100 odd years. Anyone who has kept their money in cash has generally lost money virtually non-stop.

However, in today’s world in which some $9 TRILLION in bonds are posting negative yields, cash isn’t looking so bad. Yes, you’ll still lose purchasing power over time… but the same is true if you buy bonds in Europe or Japan… just with more volatility.

Yellen’s disdain for cash isn’t that cash is a poor store of value… it’s that cash, particularly physical cash is one of the few “loopholes” in the current financial system that permits you to escape the insanity of Negative Interest Rates from Central Banks.

After all, there are two basic benefits to storing your money in a bank:

- Security

- Interest

With NIRP in place, #2 is no longer a benefit. If anything storing your money in a bank with NIRP means losing money.

This leaves #1: security.

But you can likely achieve the same security by buying a home safe and sitting on physical cash there. Indeed, this is precisely what consumers in Europe and Japan have done since Central Banks in those two regions employed NIRP.

This is why Yellen and her ilk hate cash. Central Banks want to force consumers to spend money or invest in risk assets by punishing deposits with NIRP. But physical cash avoids NIRP entirely.

Will this stop Central Banks? No way.

Indeed, we’ve uncovered a secret document outlining how the Fed plans to incinerate savings in the coming months.

We detail this paper and outline three investment strategies you can implement

right now to protect your capital from the Fed’s sinister plan in our Special Report

Survive the Fed’s War on Cash.

We are making 1,000 copies available for FREE the general public.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/cash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research