As we have repeatedly warned, anyone who is betting on the Trump Presidency unleashing a massive $USD bull market in the near future is going to get taken to the cleaners.

This has already begun…

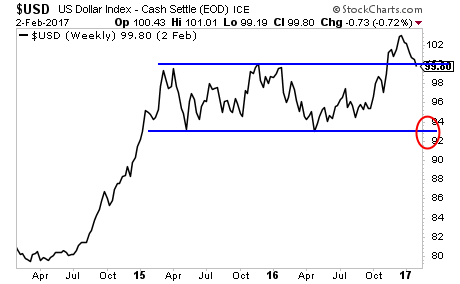

One of the single most dangerous traps for traders to avoid is a “False Breakout.”

False breakouts are moves in which an asset “breaks out” of a formation, leading many to believe that the move is legitimate… then suddenly KA-BLAM, the move reverses violently.

See the $USD today. This looks more and more like a false breakout, which means YES, the $USD is going to sub’90s if not lower within 12 months.

Those who believe Trump wants the $USD above 100 are not paying attention. Similarly, those who believe that the Fed can and will raise rates three times in 2017 are missing the big picture.

NEITHER OF THOSE IS GOING TO HAPPEN. And if you’re investing based on them, you’re in for a LOT of pain.

If you’re looking to profit from the REAL impact Trump’s Presidency will have on the market (and the massive opportunities this situation presents), we’ve put together a Special Investment Report outlining three investment strategies that will produce major returns as a result of Trump’s economic policies.

It’s titled How to Profit From the Trump Trade and we are giving away just 1,000 copies for free.

To pick up your copy, swing by

http://phoenixcapitalmarketing.com/trump.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research