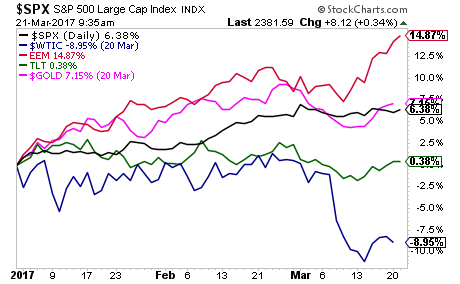

Pop quiz, name the top performing asset class of thus far this year?

If you guessed US stocks or bonds, you’re wrong. The top performing asset class hands down is Emerging Market stocks, followed by Gold, THEN the S&P 500, followed by Treasuries and finally, Oil.

Using this as a framework, let’s ask ourselves, “what macro environment would cause these respective performances? What would induce a sharp rally in Emerging Market Stocks and Gold… with US stocks trailing and Oil down sharply?”

Oil is telling us that growth is actually very weak, while Gold and Emerging markets and bonds are telling us inflation is picking up (a weak $USD sends Gold and Ems higher while it would depress bonds).

Weak growth and higher inflation… that’s called STAG-flation.

Meanwhile, the financial media is proclaiming that 2017 will be the year of major $USD strength and a roaring US economy.

Well, the markets argue otherwise. Who do you think knows more…some “guru” on CNBC or the collective intelligence of hundreds of millions of investors?

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

We make money on 86% of our investments.

That is not a typo.

A full review of every investment we’ve made since November 2014 (losers too) reveals that 86% of them were winners, including gains of 10%, 12%, 15%, 25% even 33%.

2017 is shaping up to be our best year yet. Already we’ve closed out gains of 10% in two weeks, 19% in five days, even a whopping 21% in six weeks.

You can get access to these winners and more… just take out a 30 day trial to

Private Wealth Advisory for just $0.98!!!

To do so…

Graham Summers

Chief Market Strategist

Phoenix Capital Research