Let’s face the facts.

The only reason the financial system has held together so well since 2008 is because Central Banks have created a bubble in bonds via massive QE programs and seven years of ZIRP/NIRP.

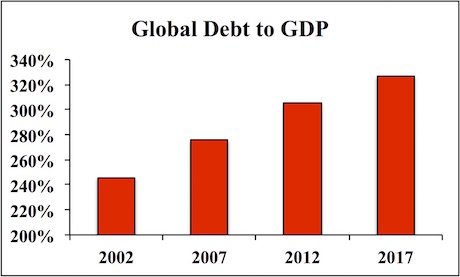

As a result of this, the entire world has gone on a debt binge issuing debt by the trillions of dollars. Today, if you looked at the world economy, you’d find it sporting a Debt to GDP ratio of over 327%.

Well guess what? The REAL situation is even worse than this. The Bank of International Settlements (the Central Banks’ Central Bank) just published a report revealing that globally the financial system has $13 trillion MORE debt hidden via junk derivatives contracts.

Global debt may be under-reported by around $13 trillion because traditional accounting practices exclude foreign exchange derivatives used to hedge international trade and foreign currency bonds, the BIS said on Sunday.

Source: Yahoo! Finance.

—————————————————————-

Are You Ready For the Next Crisis?

The markets are in a massive bubble. And when it bursts, it’s going to make smart traders very, very RICH.

Our specially designed options service The Crisis Trader is already up 34% this year, and that’s BEFORE the Crash hits.

Yes, 34%. And we’ve still got FOUR months to go this year!

Normally a service like this costs $5,000 just to try…

But you can get FOUR of The Crisis Trader’s high octane options trades for just $0.99 today.

This offer expires this Friday at midnight.

—————————————————————-

As has been the case for every single crisis since the mid’90s, the problem is derivatives.

Consider that as early as 1998, soon to be chairperson of the Commodity Futures Trading Commission (CFTC), Brooksley Born, approached Alan Greenspan, Bob Rubin, and Larry Summers (the three heads of economic policy) about derivatives.

Born said she thought derivatives should be reined in and regulated because they were getting too out of control. The response from Greenspan and company was that if she pushed for regulation that the market would “implode.”

Fast-forward to 2007, and once again unregulated derivatives trigger a massive crisis, this time regarding the Housing Bubble

And today, we find out that once again, derivatives are at the root of the current bubble (debt). And once again, the Central Banks will be cranking up the printing presses to paper over this mess when the stuff hits the fan.

Already, Central Banks are printing nearly $180 billion per month in QE. When the next crisis hits, it’s going to be well north of $250 billion if not $500 billion per month.

This is going to send inflation trades, particularly Gold, through the roof.

If you’re not taking steps to actively profit from this, it’s time to get a move on.

We just published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

We are giving away just 100 copies for FREE to the public.

As I write this, there are 19 left.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/goldmountain.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research