The US Federal Reserve has bet the farm… and the Republic on the idea that they can inflate us back to a recovery.

In plain terms, Bernanke and pals believe that if they can make the stock market rise, people will feel richer and will start spending money again, insuring that the US economy (which is 70% based on the consumer) will come roaring back to life.

The problem with this sort of thinking is that it’s so superficial as to be laughable, especially for those claiming to have an advanced education from a top university.

Indeed, the fact that the S&P 500 goes from 1,000 to 1,330 DOESN’T mean that those who own stocks are that much wealthier. This is because the nominal price of stocks (what the S&P 500 is priced at) IS NOT the same as the PURCHASING POWER of stocks.

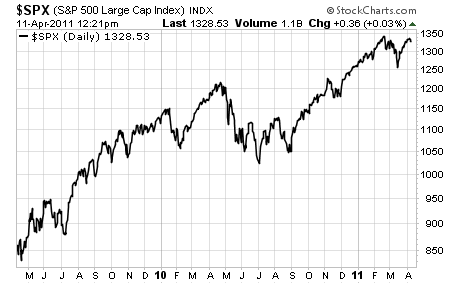

Here’s the S&P 500 priced in US Dollars. Looks like investors are getting a lot richer in a hurry doesn‘t it?

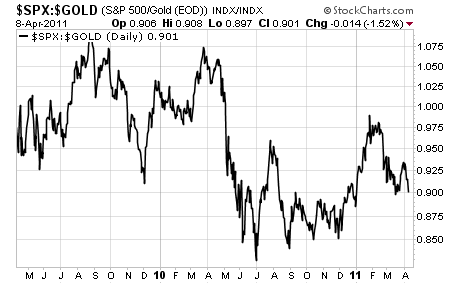

Now, here’s the S&P 500 priced in Gold: a currency that the Fed CAN’T turn into toilet paper and a real measure of purchasing power:

In simple terms, those who own stocks have not actually increased their wealth in anyway since March 2008. All they’ve done is owned an asset that increased in nominal terms ONLY when it’s priced in a rapidly devaluing currency (the US Dollar).

The fact that our monetary system is run by guys who believe that “stocks rise = WEALTH” should give you the chills. Using this level of intelligence, you could rack up $500,000 in debt buying fancy clothes and then claim you’re wealthy cause you look like you have money (which by the way is something many people have done).

This is nothing new for the financial world. Research from the London Business School shows that when you account for inflation, stocks have often LOST money for DECADES despite rising substantially in nominal terms.

A great example of this is France where investors saw NO increase in purchasing power from stocks (as in ZERO) from 1912 to 1977. That’s right, nearly THREE GENERATIONS of investors LOST wealth by owning stocks in France during the 20th century.

So if you want to buy the whole “I’m missing out by not owning stocks” BS which is slung around like it’s true, you’re being conned into the biggest scam of the century (literally). You’re also actively voting for Ben Bernanke (more on this in another essay) by supplying him with more phony evidence to claim that his insane monetary policies are working.

Meanwhile, I’ll be helping subscribers of my Private Wealth Advisory load up on inflationary hedges… and making REAL wealth in the process.

For months now I’ve been telling you that we’re focusing on extraordinary inflation hedges: companies that own incredible assets priced at levels that make them HUGE takeover targets.

I wasn’t just blowing smoke here. Just yesterday, one of our picks, TimberWest Forrest, announced that it will be bought out. Private Wealth Advisory subscribers locked in a 41% gain… in less than two months.

This comes on the heels of last month’s gains of 42%, 29%, 23%, 20%, and 18% (all REAL gains we locked in on various positions that month).

So while most folks are betting on stocks (which are up some 14% since I opened the Inflation Portfolio) we’re seeing REAL returns AND we’re actually maintaining the purchasing power of our capital by focusing only on inflation hedges.

If you’re looking for a means of profiting from Ben Bernanke’s ongoing insanity and don’t believe the whole “stocks are up so we’re getting rich” nonsense, you should take out a trial subscription to Private Wealth Advisory and start getting some major results from your investments.

To do so…

Good Investing!

Graham Summers