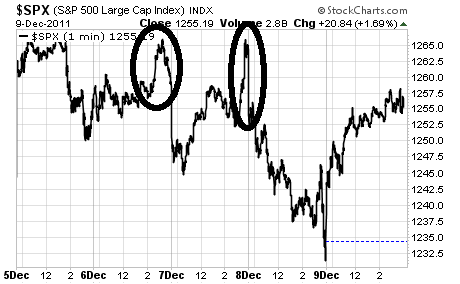

Stocks have entered a kind of fantasy world, completely detached from any kind of economic, political, or financial reality. Indeed, last week the #1 driver of stock prices was unfounded rumors that were refuted within hours of their being published (I’ve circled the rumor-based rallies in the chart below).

Again, these were rumors… based on lies… that were refuted within hours of their being published… pushing the market into vertical rallies. Like I said, we’re in La La Land.

The reality of the financial system today is that we’re entering another global economic contraction. Earning have been abysmal in the US. Europe’s banking system is in a liquidity crisis on par with the post-Lehman Brothers collapse. China is entering a hard landing. And the US economy is in a second recession within a larger DE-pression.

The reasons stocks aren’t reacting to these realities (yet) are:

1) Hedge funds and institutions are desperately trying to boost their returns before year-end (most have had HORRIBLE years)…

2) Barring REAL selling pressure, most market action is dominated by high frequency trading programs (which don’t think or make qualitative judgments)… AND

3) Traders have been conditioned to only care about one thing: more juice from the world’s central banks.

Indeed, if you want the real story for what’s happening to the world economy, take a look at the agricultural commodities. They (not stocks) were the first asset class to pick up on inflationary pressures from the Fed’s largesse in 2010. They were also the first asset class to pick up on the downturn in global economic activity in February 2011. And right now, they’re reflecting a reality that is far, FAR uglier than the one equities are discounting

This is an UGLY, DEFLATIONARY chart. It is a chart the predicts a SHARP economic contraction. Indeed, commodities as a whole don’t seem to be buying into the “risk on” atmosphere that dominated equities for most of 2011 (with the exception of late July-August).

The final, most glaring example of stocks being in La La Land comes from their inability to comprehend the current situation in Europe. Europe’s banking system is in a full-scale liquidity crisis that rivals the aftermath of Lehman Brothers’ bankruptcy. Indeed, multiple European nations are relying on the ECB to insure they don’t post FAILED bond auctions.

Against this backdrop, EU leaders just decided to impose stricter budgetary requirements from EU members. Only in La La Land could this be viewed as progress. The EU already had budgetary requirements… which the PIIGS countries all ignored. So how will these NEW budgetary requirements change anything? And who or what is going to enforce them?

And yet… stocks viewed this decision as a success. Again, we’re in La La Land.

Does this mean stocks can’t rally more from here? Not at all, in La La Land stocks can rally for no reason at all. But you should be aware that the credit, bond and commodities markets are all indicating we’re heading into a MASSIVE wave of deflation in the near future.

Remember, stocks were the last to “get it” in 2008. They’re the last to “get it” today too. And when they finally DO “get it,” we’re going to see some REAL fireworks.

On that note, if you’re an individual investor (not a day trader) looking for the means of profiting from all of this, then you NEED to check out my Private Wealth Advisory newsletter.

Private Wealth Advisory is a bi-weekly investment advisory that uses stocks and ETFs to profit from the dominant market trends.

Every two weeks I outline what’s REALLY going on behind the scenes in the markets, as well as which investments will profit best from these developments.

Case in point, Private Wealth Advisory subscribers caught the initial market Collapse in August. They’ve also profited beautifully from the ongoing turmoil in Europe as well as the volatility in the US Dollar.

In fact, we’ve closed out 32 straight winners and NO losers since JULY.

But don’t worry that all the profits have already been made. We currently have several trades open that are primed to explode higher in the coming weeks. By subscribing today, you’ll immediately be given access to them.

You’ll also gain immediate access to my Protect Your Family, Protect Your Savings, and Protect Your Portfolio Special Reports outlining how to prepare these areas of your life for the coming Great Crisis.

These reports outline:

1) how to prepare for bank holidays

2) which banks to avoid

3) how much bullion to own

4) how much cash is needed to get through systemic crises

5) how much food to stockpile, what kind to get, and where to get it

And more…

To take out an annual subscription to Private Wealth Advisory now… start profiting from the market’s gyrations (again we haven’t closed a losing trade since JULY)… and gain access to all my Special Reports…

Best Regards,

Graham Summers