The Obama administration, as it pursues re-election in 2012, is doing all it can to claim that the US economy is in fact not quite as bad as previously thought. One of the tactics is to massage GDP and jobs data. True, this practice has been in place for over a decade, but the recent January jobs report from the BLS has set, shall we say, a new high-water mark for “adjustments.”

According to the BLS, we ADDED 243,00 jobs that month. That’s an odd claim given that the BLS admits, in the very same report, that without adjustments, the US actually LOST 2.69 MILLION jobs in January

This is roughly a discrepancy of 3 MILLION jobs. And this 243,000 jobs number for January also comes along with revisions that saw roughly 50,000 jobs added in both October and November.

So according to the BLS, the US is on the upswing again, maybe not in a HUGE way, but overall things are improving: we’re adding jobs and unemployment is falling (from 8.5% to 8.3%).

These numbers make the Obama administration look good, at least relative to how it’s looked in the previous 12 months. However, they’re not reflecting as positively on two of Obama’s primary support groups: Wall Street and the US Federal Reserve.

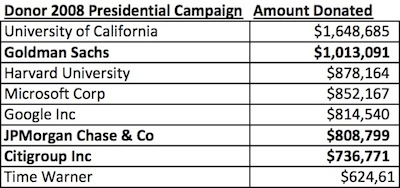

As a brief refresher, let’s take a look at Obama’s top campaign contributors in 2008:

Altogether, the finance industry ponied up $24 million for Obama in 2008. And Wall Street has not only been cutting their growth forecasts but has actually been firing people based on the fact the economy is so rough.

Altogether, the finance industry ponied up $24 million for Obama in 2008. And Wall Street has not only been cutting their growth forecasts but has actually been firing people based on the fact the economy is so rough.

N.Y. faces 10,000 Wall St. cuts through 2012

(From October 2011)

Bank of America Corp. plans to cut 30,000 jobs over the next few years, while UBS AG intends to shave 3,500 jobs and Goldman Sachs Group expects to eliminate 1,000 jobs.

http://www.marketwatch.com/story/ny-faces-10000-wall-st-cuts-through-2012-2011-10-11

As for the forecasting component:

Wall Street banks curb economic growth forecasts

(From January 2012)

Wall Street banks lowered their outlook for U.S. economic growth due to concerns over the European debt crisis, oil prices, regulatory uncertainties and “continued disarray in Washington,” according to a financial industry survey released on Tuesday.

The survey, which included bankers from Morgan Stanley, Wells Fargo Securities and Citigroup, forecast that the U.S. economy will grow at a rate of 2.2 percent this year, down from a previous forecast of 3.1 percent.

http://finance.yahoo.com/news/wall-street-banks-curb-economic-180224475.html

The January jobs report not only makes these guys look like they can’t forecast anything… but that they don’t even know how to run their own businesses. It also adds to the image that they’re heartless and will lay people off to maintain profits (if the economy is improving, why are they firing people?)

This is not exactly the best policy to maintain for constituents who have put up some big money for Obama’s campaigns in the past. One wonders if Obama’s campaign managers considered this.

The January jobs report also reflects poorly on the White House’s monetary buddy, the Obama’s administration’s “go to” guy for any kind of uptick in economic data: Ben Bernanke. After all, the Fed has also been cutting its growth forecasts and expecting higher unemployment.

US Fed cuts growth forecasts for 2012

(From November 2011)

The Federal Reserve said it now expects US growth to be weaker and unemployment higher than it thought in its last set of forecasts, as the central bank left the door open to fresh measures to help the world’s biggest economy.

http://www.telegraph.co.uk/finance/economics/8866407/US-Fed-cuts-growth-forecasts-for-2012.html

Fed foresees weak US growth through 2014

(From January 2012)

The Federal Reserve cut its US growth forecast Wednesday and said that with business investment and the housing sector depressed, it expected to keep interest rates near zero for another three years

Despite an upturn late last year, the Fed said ongoing economic weaknesses and strains in global financial markets mandated continued easy-money policies…

“I don’t think we’re ready to declare that we have entered a strong phase at this point.

So add the Fed to the group of people Obama’s jobs report leaves looking less than on top of things. On a side note, it also makes the likelihood of more QE or monetary easing from the Fed more remote (if the economy is improving, they have no reason to announce more policies… which is not positive for asset prices… or Wall Street).

This all returns to two primary themes I’ve been expounding on for months now: that the political environment has changed dramatically in the US and that we are going to see escalating tension between Wall Street, the Fed, and the White House.

The reason for this is simple: the public is growing more outraged by the minute. That anger will have to be directed somewhere. And when push comes to shove, it’s likely we’re going to see some actual real litigation relating to what happened in 2008-2009.

When this happens, the whole Fed/ Wall Street/ Politician triumvirate will begin to change dramatically. Some of these groups will try to portray themselves as “men of the people” (Obama is doing this, and so is the Fed with its recent town-hall meetings and Bernanke’s efforts to appear like a average joe who reads his kindle). Others will prepare for battle (Goldman Sachs’ CEO has hired a defense attorney).

How this will all play out remains to be seen. But the debt markets are going to speed this process up dramatically as Europe implodes and the great debt implosion comes to the US. With 48% of US citizens living in a house in which at least one person receives Government aid, you can imagine the impact that the sort of large cuts in social welfare programs that a debt restructuring in the US would have on the political process in here.

My assessment, this January jobs report is the tip of the iceberg. Tensions will be rising in the US over the next 12 months. How exactly this will play out remains to be seen (there are too many factors), but changes are coming to the political arena as well as the monetary balance between Wall Street and the Fed (remember, the Fed actually sued Goldman Sachs last year). These changes will be dramatic.

If you’re looking for actionable advice on how to play the markets as well as real-world business ideas on how to generate wealth in this tough economy, I suggest checking out my Private Wealth Advisory newsletter.

Private Wealth Advisory is my bi-weekly investment advisory published to my private clients. In it I outline what’s going on “behind the scenes” in the markets as well as which investments are aimed to perform best in the future (both in the capital markets and in the real world economy).

My research has been featured in RollingStone, The New York Post, CNN Money, the Glenn Beck Show, and more. And my clients include analysts and strategists at many of the largest financial firms in the world.

To learn more about Private Wealth Advisory and how it can help you navigate the markets successfully…

Graham Summers

Chief Market Strategist