Everyone in the media is viewing the latest announcements out of the EU Summit as game-changers.

They are not.

One facet of the deal is that ESM/ EFSF loans to troubled countries will not subordinate private bondholders holdings. While this does serve the purpose of allowing private bondholders to feel that should a country default, they might get their money back sooner (as opposed to what happened in Greece)… it doesn’t change the more critical issue of stopping defaults from happening.

Indeed, if Spain were to default, the fact that I as a potential private bondholder would be further up the line to collect my funds doesn’t do me a whole lot of good, does it? My money’s gone, at least most of it. So the benefits of this move are of borderline significance.

Moreover, none of the measures address the most critical issue pertaining to Europe: where is the money going to come from?

As I have noted before, the European Stability Mechanism, which everyone sees as the ultimate savior for the EU, does NOT exist yet. Only four out of the required 17 countries have ratified its legislation.

And the due date for ratification? July 9th.

So we have less than two weeks for 14 EU members to ratify the ESM.

Another interesting fact about the ESM… Spain and Italy will contribute 30% of its funding. So… the mega-bailout fund which is going to save Spain and Italy is receiving nearly one third of its funds from the very same countries it’s going to bail out!?!

You couldn’t make this stuff up if you tried.

Another topic worth discussing is the fact that EU leaders didn’t agree to increase the EFSF or the ESM. The simple and obvious reason for this is no one has the funds to do this.

I’ve been saying this for months. No one seems to be listening: Europe is out of buyers. End of story. There simply isn’t €500 billion lying around to be put to use. That’s why the ESM and EFSF aren’t being increased in size. They couldn’t be.

Another point, and perhaps the most key one is that the ECB will now be using bailout funds to help recapitalize EU banks. This move will ultimately end up hurting the banks that seek funding from the ECB much as those firms which drew on the ECB’s LTRO1 and LTRO 2 schemes found themselves severely punished in the credit and bond markets.

After all, requesting aid is essentially a public admission that one’s bank is in major trouble. In this end this hurts the bank seeking aid as everyone now knows that it’s on the ropes.

Indeed, as we saw with LTRO 2 (which provided over €500 billion to EU banks), those banks that drew on the ECB saw, at most, one month’s worth of gains before they were right back to where they started in terms of share price and funding needs.

Oh, and none of this will go into effect until December. Let’s hope Spain and Italy and others don’t need the funds before then!

My take on this whole mess?

1) The benefits of the announcements (lower yields on sovereign bonds and higher share prices in EU banks) will be short-lived.

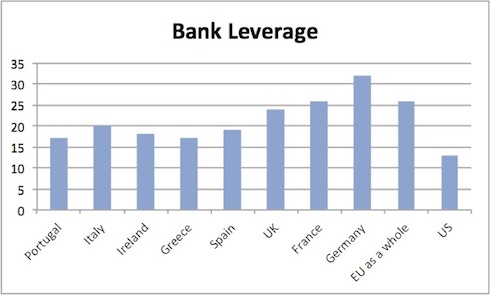

2) None of these decisions address the core issues facing the EU banking system: namely, insolvency and excessive leverage.

3) No one in the EU actually has the money to make these measures work (again, Spain and Italy will provide 30% of the ESM’s funding).

Markets will stage a knee jerk reaction to these measures. That reaction will see bank shares rise and yields fall, temporarily. But this move will be short-lived, just as moves following LTRO1 and LTRO 2 were. After all, these announcements are just more political measures than anything else. And Europe needs capital NOT politics at this point.

So I would expect this rally and the drop in bonds to be short-lived. EU leaders may have put off the Crisis by a few weeks (or perhaps even a month). But they still haven’t addressed the core issues causing the Crisis: excess leverage courtesy of hundreds of billions of Euros’ worth of garbage debt.

With that in mind, I would use this rally to further prepare for the EU Crisis.

With that in mind, I’ve begun positioning subscribers of my Private Wealth Advisory for this very possibility. We’ve already locked in over 30 winning trades this year by finding “out of the way” investments few investors know about and timing our positions to benefit from the various developments in Europe. When you combine this with our 2011 track record, we’ve had 65 straight winners and not one closed loser since July 2011. If you think this is sounds “too good to be true,” you can Click Here to See Our Confirmed Trades.

Indeed, we just locked in two gains of 8% and 10% in less than two weeks’ time. In fact, this track record is getting so much attention that we’ve decided to only make 100 more slots available before we close the doors on this newsletter and simply start a waiting list. Already 60 slots have been reserved, leaving just 40 left.

To learn more about Private Wealth Advisory and lock in one of those last 40 slots…

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital Research