We’re introducing a new component to Gains Pains & Capital: politics.

While I’ve stayed out of commenting on the US Presidential elections and politics in general for the most part, at this point so much is riding on public policy globally that we cannot analyze the markets or economy without taking it into account.

This new segment will be located at the bottom of our daily commentary. If you don’t care to read it, please just skip it. But we believe this will bring an added dimension to our work that you’ll find useful.

Now let’s first assess the markets.

We know from various sources that there is a coordinated effort to keep things calm until after the US election. Based on this, we can deduce that QE 3 was due to one of two reasons:

1) Propping the markets up until November… or,

2) Something bad is coming down the pike and the Fed wanted to act preemptively.

It’s really a toss up (or could be a combination of both). There is certainly no lack of major issues that all have negative implications for the markets. Among the more pressing are the threat of a sharp global downturn (China, the EU, and the US are all in recession), armed conflict in the Middle East, and the EU’s ongoing banking and sovereign debt crisis.

In light of this, it’s not surprising that the Fed has opted to get more money into the system. What is surprising however is that it’s turned out to be such a dud.

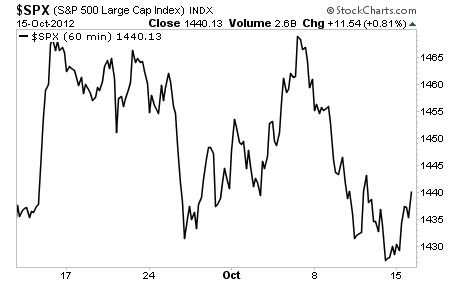

QE 3 was announced on September 13. Since that time the markets have done a whole lot of nothing. In fact, they are barely up since the QE 3 announcement.

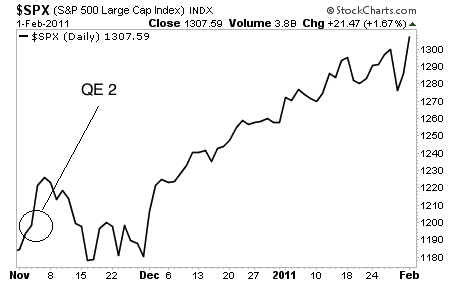

We did see a similar correction for about a month following QE 2 in 2010, however after that stocks hit lift off and didn’t look back:

It’s now been a month since the announcement of QE 3. So, if it’s going to have a similar impact to QE 2 as far as stocks are concerned, the markets need to start roaring higher now.

Alternatively, we could indeed have reached the end game for Fed intervention: a time in which the one positive aspect of QE (namely stocks rising) is no longer facilitated by more buying.

If that is the case, then the markets are in big trouble because the negative consequence of QE (higher cost of living) certainly isn’t being held in check, no matter what the Fed claims

So, the multi-trillion Dollar question is:

1) Has the Fed overdone it? Has it finally used up its toolbox to the point that even an open-ended program has little effect on the markets?

Once the Fed decided to backstop the system, there was always the threat of this occurring. You cannot have the capital markets based on moral hazard/ intervention. It not only confounds the very purpose of the markets (aligning capital with opportunity), but it leads to greater and greater dependence on the Fed’s intervention. And at some point eventually the markets no longer respond to the juice.

Can the Fed hold things together until November? I cannot say. But unless the markets start rallying hard soon, then the Fed’s in big trouble.

Now for the politics.

The outcome of this Presidential election will be of tremendous import for both the markets and the economy. During the first four years of its Presidency, the Obama administration has relied heavily on Bernanke’s Fed to hold the system together (remember, it was Obama who re-appointed Ben Bernanke, paving the way for QE lite, QE 2, Operation Twist, etc).

As a result of this, the recovery has been anemic to say the least. I can tell you point blank that the latest spat of improved economic data is not authentic or accurate. I won’t waste time with the methodology (that would take multiple pages of numbers) but I can say point blank that employment has not in fact fallen as the headline number indicates.

Aside from this, the cost of living has increased dramatically while Obama was in office. One can point fingers as for why this is, but at the end of the day, the reality is that Obama put Bernanke back in office and has never attempted to keep our Money Printer in Chief in check.

Thus, our economy has become one of Central Planning: an economy in which the primary driver of things is Central Bank intervention.

So if Obama wins again, there will be absolute hell to pay down the road. The recipe for hyperinflation has always been the same: Government monetization of a massive deficit. The US has run $1 trillion+ deficits for four years now.

Today, the Fed accounts for over 70% of all US Debt purchases. The only reason we’ve been able to get away from this is that the US has not totally lost credibility in the bond markets (yet).

However, to assume that Treasuries will always have a bid is a very dangerous assumption. If we continue down this same path of monetizing the US’s deficit via Fed money printing then at some point we will lose credibility in the markets. At that point the US Dollar will collapse and hyperinflation will hit.

There is no indication that the Obama administration has even considered this eventuality. Indeed, I have not heard anyone on the left refer to Bernanke or the poison of his policies at any point in the last few months.

On that note, I’m currently preparing a Special One Time Report devoted to outlining what will happen to both the markets and the economy depending on who wins this election.

In it I will outline the major developments that will occur in terms of monetary policy, the US economy, and the stock market depending on who wins on November 6. I’ll also outline which investments will perform best in a Romney Presidency and which investments will perform best if Obama wins again.

This Report will be given to all of my Private Wealth Advisory subscribers free of charge. It will go live tomorrow after the market’s close. If you’d like to reserve a copy, all you need to do is take out a subscription to Private Wealth Advisory. It’ll then be delivered to your inbox as soon as it’s ready.

To take out a Private Wealth Advisory subscription…

Private Wealth Advisory comes with a 30 day refund policy. So if you decide it’s not for you at any point during the first 30 days, just drop us a line and we’ll issue a full refund.

Best Regards,

Graham Summers