Looking around the economic and financial world today, I see countless negative developments and virtually no positive developments to speak of.

Just off the cuff, I note that:

- China is entering a hard landing if not an outright economic collapse.

- Europe is facing a recession, banking collapse, sovereign crisis, and a potential break-up.

- The US is in a stagflationary recession.

- Japan is in a sovereign debt crisis, approaching armed conflict with China

- Inflationary pressures are increasing worldwide: new record food prices will hit within the next 12 months.

- The risk of armed conflict is increasing in the Middle East as well as Asia along with food inflation creating civil unrest/ riots.

Against this backdrop, the one remotely positive development as far as the markets are concerned is the belief that Central banks will somehow solve these problems via endless liquidity.

However, even this is now proving to be a false premise.

The problem with this is that the primary driver of stock prices over the last three years has been the anticipation of more monetary stimulus from Central Banks.

Indeed, the New York Fed itself has openly admitted that were it to remove the market moves that occurred around Fed FOMC meetings (the times when the Fed announced new programs or hinted at doing so), the S&P 500 would be at 600 today:

So, by announcing a program that will be on going in nature, the Fed has removed the anticipation of future Central Bank intervention from investors’ psychologies. This could become highly problematic, especially if these latest announcements turn out to be duds.

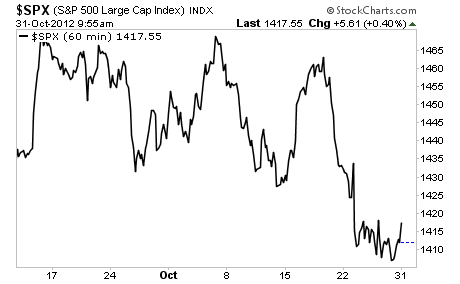

Sure enough, stocks are actually down since QE 3 was announced on September 13 2012.

So we’ve got over 50% of the global GDP (China, the EU, and the US) in recession, combined with Europe’s banking and sovereign crisis… at the exact time that the Fed appears to have run out of ammo.

It’s truly astounding. I cannot actually remember a single time in which the global economy and financial system have faced this many difficulties. And that includes the build up to the 2008 Crash.

Now more than ever, investors need to get access to high quality guidance and insights. There sheer magnitude of the issues the global financial system is facing is enormous!

For that reason, we are lowering the price of an annual subscription of my Private Wealth Advisory newsletter to just $249 (down from $300).

Private Wealth Advisory is my bi-weekly investment advisory service tailor made for individual investors who want to stay informed of the real story in the global economy and outperform markets.

To whit, my clients made money in 2008. And we’ve been playing the Euro Crisis to perfection, with our portfolio returning 34% between July 31 2011 and July 31 2012 (compared to a 2% return for the S&P 500).

And this incredible newsletter is now on sale at $249 for the next six days (until next Tuesday).

So if you’ve been holding off on subscribing to Private Wealth Advisory for whatever reason, this is your one chance to subscribe now, and lock in a price of $249 for the lifetime of your subscription.

Because once next Tuesday hits, the price is going back up to $299 and will stay there for good.

To take advantage of this Special One Time offer… and start receiving my hard hitting, global market investment commentary delivered to your inbox every other Wednesday…

Best Regards,

Graham Summers