The market is beyond overstretched at this point on a short-term, intermediate term, and long-term basis. The sheer number of warning signals is staggering.

The blow off top out of the rising wedge pattern we noted before is rolling over indicating this is likely a false breakout:

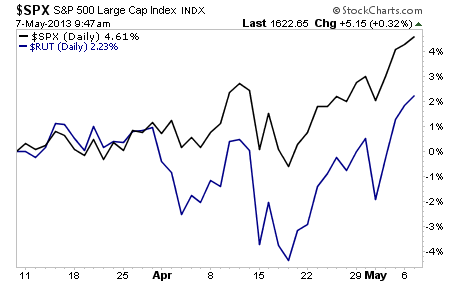

The Russell 2000 is lagging well behind the S&P 500. Small caps, in general, should lead a rally if it’s going to prove legit:

China, which has lead the S&P 500 in general since the 2009 bottom peaked months ago:

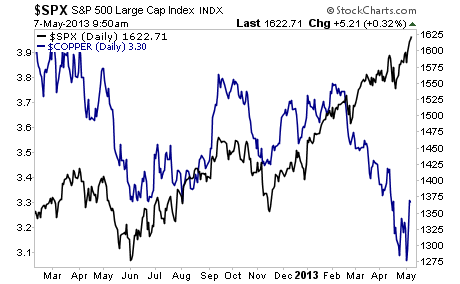

Copper, which serves as an excellent proxy for the global economy, is collapsing, showing that this rally in stocks is occurring while the global economy gets weaker and weaker.

Investors take note, the market may be hitting new highs thanks to traders’ games, but the real economy is contracting sharply. This is precisely what happened during the market peaks before the Tech Crash and the 2008 Collapse.

We are getting precisely the same warnings this time around.

If you are not already preparing for a potential market collapse, now is the time to be doing so.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… having just seen another SIX trade winning streak…

To join us…

Best Regards,

Graham Summers