The markets are rallying today because Bernanke and the Fed meet on Wednesday and will announce their new policies (if any).

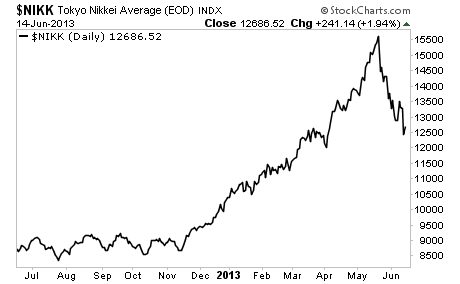

Someone might want to explain to them that the Nikkei just collapsed in spite of Central Bank policy. The bank of Japan announced it would buy $1.4 trillion worth of assets (roughly 25% of Japan’s GDP) in early April. The Nikkei has already wiped out almost all of the gains since that time.

Still, US bulls continue to hope that Bernanke will engage in even more QE, despite the fact the Fed has an $85 billion per month QE policy in place already, which comes to over $1 trillion in QE per year.

Given that the Fed’s balance sheet is already over $3 trillion and will be over $4 trillion within 12 months, one has to wonder just what Bernanke can do. His best bet is to retire in January and let someone else try and manage the mess he created.

So let’s see what happens on Wednesday. The markets will likely rally until then on hopes of more juice from Bernanke. But if he should disappoint at all (read: not announce something more or at least strongly hint at doing so) then buckle up.

I’ve been warning subscribers of my Private Wealth Advisory newsletter that we were heading for a dark period in the stock market. We’ve since taken action to insure that when the market falls, we make money.

Indeed, in the last month alone we’ve seen gains of 8%, 12%, 21%, and 28%… all from basic stocks and bonds. And we’re now preparing with six carefully targeted investments that will pay out when the market falls.

To find out what they are, all you need to do is take out a trial subscription to Private Wealth Advisory. You’ll immediately be given access to the Private Wealth Advisory archives outlining our investment strategies.

You’ll also be given access to FIVE Special Reports (an $800 value) outlining the biggest risks to the financial system as well as the best means of protecting yourself and your loved ones from them.

To take out a trial subscription to Private Wealth Advisory and take action to make sure the coming months are a time of profit, not pain.

Best Regards,

Graham Summers