The biggest single most important item in the GDP report yesterday was the collapse in disposable income for Americans.

Most investors will focus on the drop in GDP growth for 1Q13 and view it as opening the door for the Fed to continue with QE 3 and QE 4 without any tapering in sight.

After all, the markets have believed that bad economic news is good news for the markets for four years based on the belief that a weak economy will mean more money printing from the Fed.

However, the real issue in the BEA’s report on GDP growth was the collapse in real per capita disposable income which fell at a annualized rate of 9.21%.

That is a truly staggering collapse in incomes. The last time we say anything even close to this was in the third quarter of 2008.

That was right after Lehman failed and the entire economy and stock market were melting down. Buckle up, things are getting worse in the US at a truly alarming rate.

I’ve been warning subscribers of Private Wealth Advisory that the economy was going to turn sharply weaker this year. It’s already begun.

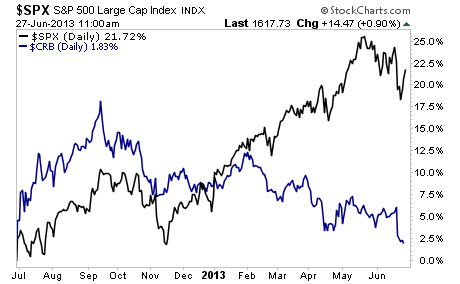

Indeed, while most investors will look at the GDP report as indicating more QE is coming, commodities certainly didn’t get that signal at all. The commodity index continues to plunge diverging wildly from the S&P 500.

One of these asset classes is completely mispricing the economy and the likelihood of more QE. Guess which one it is.

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING. In fact we just locked in four straight gains of 8%, 12%, 21% and 28% in the last month ALONE. In fact we just closed another yesterday bringing our new winning streak to NINE trades.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… To join us…

Best Regards,

Graham Summers