Yesterday’s move confirms what everyone suspected, that Ben Bernanke is more of a CNBC stock market cheerleader than a Fed Chairman or businessman. Is there really any other interpretation for his clear and obvious verbal intervention in the stock market? Can we really look at his actions and say that this is a man who legitimately knows what he is doing?

After all, Bernanke did not actually introduce any new policies. His Fed is torn about how to proceed with half of the Fed Board wanting to end QE by the end of 2013. And yet Bernanke felt the need to speak after the market closed about how he will keep the money printers going ad infinitum.

Who cares if the entire recovery is based on accounting gimmicks? Who cares if there is literally no evidence in history that QE generates economic growth? Who cares that Bernanke is literally betting the financial system that his flawed theories are in fact correct? Stocks must go higher!

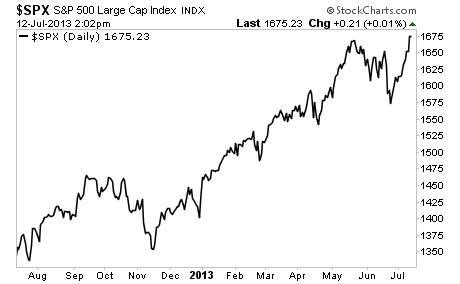

We did eek out a new high in the S&P 500 yesterday.

The move is very reminiscent of the 2007 top where we had a top, a brief collapse and then a final burst higher to a new high. Within a few months however, the markets had begun to descend into what would ultimately be the worst Crisis in 100 years.

Indeed, it is almost impossible to make the case that stocks are starting another major move up here. We have, in no certain order:

1) A collapse in corporate earnings

2) The collapse in US GDP

3) The European banking crisis back

4) The European sovereign crisis back (Portugal’s 10 year spiked above 8%)

5) China’s hard landing (electrical consumption is up just 2.3%)

6) A Fed that is literally beginning to mutiny with calls to end QE growing louder by the week

Against this backdrop, stocks are undoubtedly in a bubble. Today, the S&P 500 is sitting a full 30% above its200-weekly moving average. We have NEVER been this overextended above this line at any point in the last 20 years.

Indeed, if you compare where the S&P 500 is relative to this line, we’re even MORE overbought that we were going into the 2007 peak at the top of the housing bubble.

We all know how bubbles end: BADLY.

This time will be no different. The last time a major bubble of these proportions burst, we fell to break through this line in a matter of weeks.

We then plunged into one of the worst market Crashes of all time.

By today’s metrics, this would mean the S&P 500 falling to 1,300 then eventually plummeting to new lows.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

With that in mind, I’ve already urged my Private WealthAdvisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers