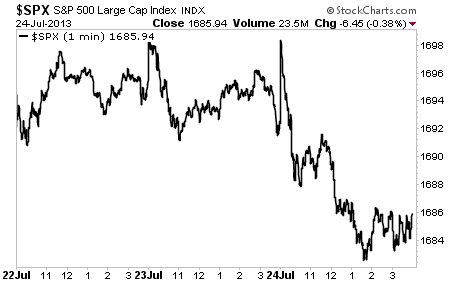

The markets had a very weak session yesterday. With Bernanke’s final stand in front of Congress out of the way, along with options expiration and end of the quarter performance gaming, the bulls are running out of excuses to gun the market higher.

This is evident in the action of the last three days. All three days traders tried to push the market higher at the open. However, there was no follow through and every time the market retracted the early gains. As I’ve told subscribers of Private Wealth Advisory is not indicative of major buying power coming into the markets.

Yesterday we noted that the corrupt edifice that has sustained the “recovery” is crumbling. A big part of this edifice is the Fed and its role as regulator of monetary policy and the banking system.

The Fed publicly claims it wants to help the economy and Main Street. However, as we are now discovering, the Fed is more than willing to sacrifice the good of the people in order to prop up a few insolvent big banks.

Bernanke and other Fed doves continue to proclaim that QE is beneficial to the economy. However, we now know from the former head of the BLS that the Fed’s claims of job growth are incredibly inaccurate (real unemployment is over 10%) as well as its claims of low inflation (real inflation is around 8%).

Higher costs and lower job growth. Neither of those is pro-recovery or pro-Main Street.

Moreover, we now find that Wall Street has been manipulating the commodities market as well as the interest rate markets: both of which have major impacts on average Americans.

If the Fed didn’t know about this, then how can anyone trust the Fed to understand the financial system, let alone “save” it? And if the Fed did know about this, then it’s proof positive that Bernanke is happy to turn a blind eye to Wall Street’s pushing of commodity prices higher (hurting Americans across the board).

I’ve long said that this entire recovery was a sham. Real employment has yet to come back in any meaningful way. And the housing “recovery” has been dominated by large financial institutions (ones with close ties to the Fed) buying up tens of thousands of homes, pushing prices higher to the point that once again Americans can’t afford them.

It’s just like 2007 all over again. Only this time around, we know for a fact that the Fed hasn’t fixed things and has bankrupted itself and the financial system pretending that it can.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

The time to prepare for this is not once the collapse begins, but NOW, while stocks are still rallying. Stocks take their time moving up, but when they crash it happens VERY quickly.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in nine winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers