The markets fell yesterday despite the Fed pumping over $5 billion into the system. The primary reason is that the Fed is once again talking about tapering QE. There’s also the uncertainty of who the next Fed Chairman will be (Larry Summers’ odds of filling the roll can be correlated to the dips in the market as Summers has been critical of QE in the past).

Stocks are on the edge of a small cliff. It we take it out we could go to 1650 in a heartbeat. And it we take out 1625, then look out, we’ll likely wipe out several months of gains in a short period.

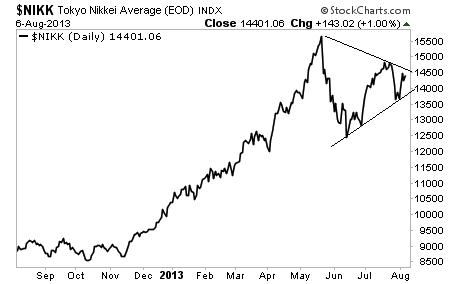

Speaking of which, the Nikkei has formed a triangle pattern. Watch this formation closely. Japan is leading the US as far as markets are concerned. A breakdown here would signal a major correction in US stocks.

In the US, the Fed continues to argue that money printing and QE can generate growth. There is literally no evidence of this in history. Japan and the UK have both engaged in massive QE programs to little or no effect.

However, the Fed is terrified of losing control of the system, so it wants to continue doing anything no matter how futile in order to maintain the appearance of confidence. God forbid anyone figures out the emperor has no clothes…

Folks, there is no other way to put this… the markets are in a massive bubble. And when it bursts, things will get ugly very FAST.

With that in mind, I’ve already urged my Private Wealth Advisory clients to start prepping. We’ve opened six targeted trades to profit from the stock bubble bursting.

We’ve also taken care to prepare our finances and our loved ones for what’s coming, by following simple easy to follow steps concerning our savings, portfolios, and personal security via my Protect Your Family, Protect Your Savings & Protect Your Portfolio reports.

I’ve helped thousands of investors manage their risk and profit from market collapses. During the EU Crisis we locked in 72 straight winning trades and not one loser, including gains of 18%, 28% and more.

In fact, we’re currently on another winning streak having locked in ELEVEN winning trades in the last two months, including gains of 21% and 25%.

All for the small price of $299: the annual cost of a Private Wealth Advisory subscription.

To take action to prepare for what’s coming… and start taking steps to insure that when this bubble bursts you don’t lose your shirt.

Yours in Profits,

Graham Summers