The market is erupting higher on the usual start of the month buying and some gimmicked economic data out of Europe.

In this case, the specific data point in question is Europe’s Performance of Manufacturing Index or PMI, which rose to a 26 month high. This, combined with claims that Europe’s recession is “over” has convinced traders that the European crisis has officially been put to rest.

I’ve written at length about how politics drives everything in Europe (particularly the media). German Chancellor Angela Merkel, the woman with her finger on the “bailout” button for Europe, is up for re-election at the end of September. It is not coincidence that we’ve seen a sudden improvement in Europe’s economic data in the last two months going into this event.

After all, the alternative to Merkel’s re-election is politically unsavory for Europe: Merkel’s primary opposition wants an end to the bailouts and Germany out of the Euro.

If you were a totally bankrupt European Government relying on the promise of additional funds from Germany to stay in power and your options were A) start cranking out better data now with the promise of future bailouts from Germany or B) having to deal with a German Chancellor who wants out of the Euro… which would you choose?

Indeed, if the European Crisis is over, why did Germany’s Finance Minister just admit that Greece needs another bailout? It’s been nearly four years since Greece’s debt woes first surfaced officially. Four years and three bailouts later and Greece is still not fixed… but the European recession is over as is the European debt Crisis?

Right.

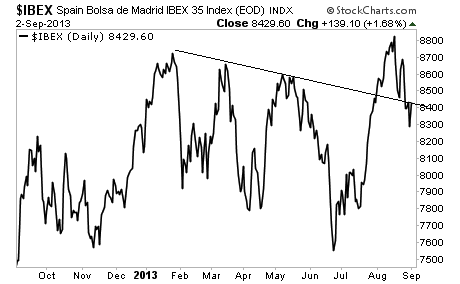

This move today feels like a dead cat bounce. Spain’s stock market, the Ibex, which remains the canary in the coalmine for Europe, is rallying to retest former support:

If we cannot break back above this line and stay there, then the market has called BS on the media’s campaign to convince the world that Europe is fine.

On that note, I’ve already prepared readers of my Private Wealth Advisory newsletter with a number of targeted investment strategies designed to help them not only manage risk, but produce outsized profits during the coming economic slowdown.

Already we’ve locked in 14 straight winners over the last two months. More are coming.

Indeed, during the first round of the Euro Crisis we locked in 73 straight winning trades and not one single closed loser. That was during a time when the market went nowhere.

So we’re getting ready for another similar winning streak during this next round of economic contraction. You can make money during times of slow growth, but you need the right investment strategies.

If these sound like the kind of investment strategies you could use for your portfolio, I suggest taking out a trial subscription to Private Wealth Advisory. You’ll immediately begin receiving my bi-weekly investment reports outlining the most important developments in the market.

You’ll also receive my real-time trade alerts, telling you the minute it’s time to open or sell a trade.

All just for $299 a year.

You get:

- 26 bi-weekly investment reports (ranging from 15-30 pages in length)

- Six Special Reports outlining unique opportunities and risks in the markets that 99% of investors don’t know about.

- 30-50 trades per year provided to you in real time

- The sense of calm in knowing that you’ve got your financial house in order.

To sign up for Private Wealth Advisory…

Yours in Profits,

Graham Summers

Chief Market Strategist

Phoenix Capital Research