Editor’s Note: Tom Langdon (a pseudonym) is a former intelligence officer and Wall Street trader with over 25 years of experience advising institutional clients, government officials and business executives. Previously selected by the Wall Street Journal for its “Best of the Street” stock pickers and singled out multiple times by the Institutional Investor All America Research Team, Tom has a lengthy track record of making major calls and showing investors (both institutional and private) how to outperform the markets with minimal risk.

Governments are on a short leash – globally.

Five plus years after the Great Recession few populations are satisfied with their governments and new parties and movements continue to emerge, whether the Tea Party (US), AfD (Germany), Aam Aadmi Party (India), and unfortunately violent groups like Golden Dawn (Greece).

We see major issues in most political arenas primarily as a result of the political instability. Whether we consider the US, the EU, India, or China, all major regimes are finding themselves more accountable to populations that are growing increasingly dissatisfied with the status quo.

Japan is the exception.

Prime Minister Shinzo Abe actually has a mandate and a game plan. The world can squabble about this plan, but at the end of the day, everybody else has used their paper currency as a weapon, or tried to, and Japan is taking its turn.

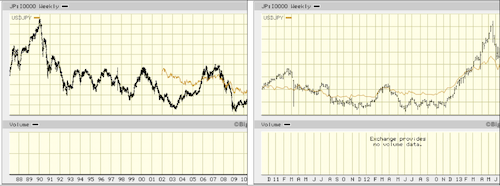

For investors, the question is whether you think the move in the Yen and the Nikkei is sustainable. Our answer is unequivocally yes. Prime Minister Abe learned some lessons from his first run as PM – which ended after one year in 2007 – and is riding high in popularity at 60% – an almost unheard of level for a Japanese politician.

Challenges will come – he will likely seek to leverage control of both houses of Japanese Parliament into reforms in labor, agriculture, healthcare and women in the workplace – all sorely needed in a country with a low birth rate and no desire to assimilate immigrants.

We like to swim downstream. Investors do well when nations put sound long-term economic policies in place, and likewise profitable trades can be realized when governments or ministries make moves that can help the short term.

Japan’s export industries managed to survive a currency that appreciated by 30% over a decade while others depreciated – which means their cost structures are lean as hell – and you can expect them to compete more effectively with the currency wind going the other way.

Indeed, a Japanese process control manufacturer, which we track closely because of our management access and information quality, recently reported a 20% sales increase, largely because of currency.

Because nearly all its cost structure is denominated in Yen, the cost of goods sold and SG&A only rose 15-16% and allowed operating profit to increase by over 80%! Needless to say, no Western industrial executive we speak to had a similar result to report. That sort of thing makes Japanese stocks rise and boosting the savings and happiness of Japanese investors/voters.

Abe-nomics is not without its problems, but it is greatly boosting corporate profits in Japan. This remains a dominant theme for us going forward as we look for investment opportunities.

Sincerely,

Tom Langdon