For over four years now, the mainstream media continues to parrot the Federal Reserve’s assertion that QE is in fact a monetary tool that will create jobs.

This assertion overlooks Japan, where QE efforts equal to over 25% of GDP have failed to improve the unemployment situation significantly, as well as the UK where QE efforts equal to over 20% of GDP have proven similarly ineffective.

We now can definitively add the US to the list of QE failures.

It’s been 14 months since the Fed announced QE 3 and nearly 12 months since it announced QE 4: both open ended programs that have run continuously since they were announced.

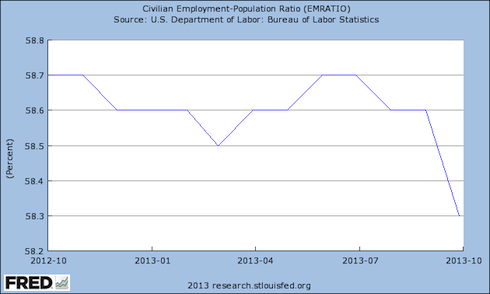

And yet through this period the employment population ratio (which measures the percentage of working age adults who are in fact employed) has in fact FALLEN.

The above graph shows in clear terms that the US is not creating jobs at a rate that can account for population growth. QE 3 and QE 4 have failed to have any significant effect. In fact, if you consider that the chart has dropped dramatically in the last quarter (giving QE 3 and QE 4 a year to have an effect) one can definitively say that QE has been a total failure as far as jobs growth is concerned.

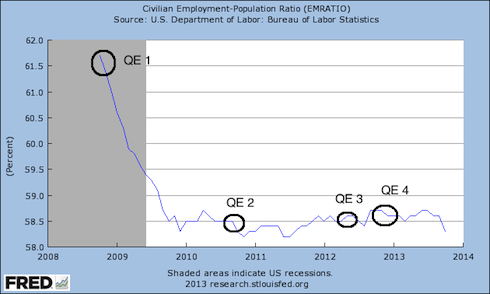

This is nothing new. If you look at the five-year chart you cannot with a straight face say QE has succeeded in any meaningful way.

QE does not create jobs. It has been a total failure. And yet, five years after the Fed embarked on this policy we continue to hear people talk about how the real problem is that we need MORE QE.

QE failed for Japan. It has failed for the UK. It ha failed for the US. Collectively, countries comprising over a third of the world’s GDP have proven QE doesn’t work.

However, this is not to say that there are not tremendous opportunities for stock pickers in this environment.

Indeed, recently, subscribers of our value stock picking newsletter Cigar Butts & Moats locked in a 28% gain on our latest stock pick in less than one month.

We did this by buying a deeply undervalued business. Based on its market valuation, this company could easily take itself private, using the cash generated from operations to pay the loan required to buyback all of its shares on the open market.

In fact, this business was so cheap that it could do this even if its earnings fell in HALF.

That’s one heck of a margin of safety. We bought on October 3 2013. And we closed out on October 23 2013 for a 28% gain.

Over the same time period, the S&P 500 rose just 4%.

This is how to make a killing in the market today: by focusing on value stock picking. It’s the very reason we launched Cigar Butts & Moats.

The price of an annual subscription to Cigar Butts & Moats is just $79.99.

For that price you get:

- 12 monthly issues of Cigar Butts & Moats

- Our proprietary deep value Investment Special Report How to Make a Fortune With Value Investing (a $199 value) which outlines specifically how Warren Buffett made his fortune investing in stocks.

- All of our other Special Investment Reports outlining special investment opportunities.

- Real time investment updates as needed (like the one that told investors to lock in a 28% gain).

All of this for just $79.99.

To take out an annual subscription to Cigar Butts & Moats…

Best Regards

Phoenix Capital Research