Perhaps the single most misunderstood item in the financial world is the Chicago Board Of Options Volatility Index, or VIX.

The VIX is a measure of how much investors are willing to pay for portfolio “insurance.” If they’re willing to pay a lot (the VIX is high), then it’s assumed investors are nervous. If they don’t want to pay much (the VIX is low), then it’s assumed investors are calm and expecting blue skies ahead

Because of this, most investors, including the majority of professional investors, believe the VIX provides a reliable barometer of market risk.

This is not true. The reason is because investors are usually greedy when they should be fearful and vice versa. If the VIX is up, it’s not because the market is “risky” or at risk of falling… it’s because the market already FELL!

As anyone knows, the time to buy stocks is when they’re “low” as in “buy low, sell high.” But as I just explained, stocks are usually “low” when they’ve already fallen (which would mean the VIX is already spiking). Put another way, the VIX doesn’t really measure risk per se… instead it shows you when investors are panicked… and that’s when you should consider buying

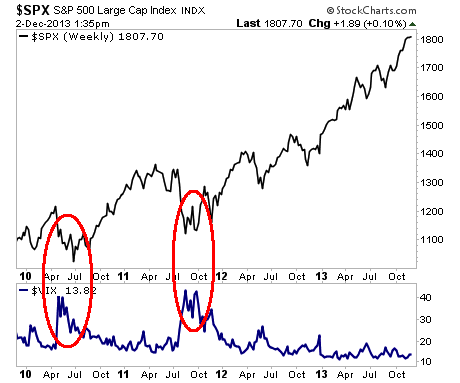

Take a look at the above chart. Everytime the VIX spiked (the blue line below), the market had already dropped and was in the process of bottoming.

Now let’s look at a longer-term chart. Once again, the VIX spiked after the market had already plunged. In fact, buying stocks around the time the VIX spiked was a GREAT way to trade the market going back for years. If you had done this, you would have profited handsomely.

If you want to make a killing in the markets, you need to be willing to see the world the way it really is, NOT how you THINK it is. Most investors think the VIX measures the market’s risk, but really, it’s almost the opposite: the VIX almost always picks market bottoms!

With my weekly premium investment newsletter Global Alpha Trader, I show investors how to play the market using this and other proprietary “risk reward” metrics I’ve developed in over 25 years on Wall Street.

During that time I’ve built up an arsenal of how to find “out of the way” investment ideas that will make you money while always minimizing your risk.

For instance, in the last month alone I’ve alerted subscribers to:

1) An extraordinary energy asset play that corporate insiders are loading up on. If the market even begins to sniff the value here, we could easily see gains of 400%.

2) A back-door play on China and India’s ongoing infrastructure boom that Wall Street TOTALLY misunderstands. We could easily see a double-digit winner here within six months.

3) The single most important theme for the global economy in the year 2014. I call this “the Great Game” but for you it will result in GREAT profits. Indeed, I’ve got three investments based on this theme which could return as much as 800% in the next 24 months.

And much, much more.

An annual subscription to Global Alpha Trader costs $499.99.

Considering these are the same insights my institutional clients used to pay me six figures for when I worked on Wall Street, this is an absolute steal.

Each subscription to Global Alpha Trader comes with:

1) 52 weekly issues of Global Alpha Trader (featuring at least 20 actionable investment ideas per year)

2) The 400% Energy Opportunity Wall Street Won’t Tell You About Special Report

3) The Global Alpha Trader investment manual.

4) Real time trade alerts telling you when to buy or sell an investment.

5) EVERY Special Report I write between now and December 2014.

… And much more.

You can even keep the investment reports if you decide Global Alpha Trader is not for you and cancel during the first two months for a full refund.

How’s that for a low risk proposition?

To take out an annual subscription to Global Alpha Trader…

Best Regards

Tom Langdon