Over the last five years, the US Federal Reserve has substantially changed the investing landscape of the capital markets in the last 12 months. In particular we need to assess how ongoing QE programs affect notions of “risk” and rates.

In the period from March 2008 to late 2013, the Federal took a series of strategic steps to attempt to rein in the financial crisis and to support certain financial institutions that it deemed most critical to the health of the financial system.

These steps consisted of cutting interest rates to zero and engaging in rounds of Quantitative Easing, commonly referred to as QE.

QE in its simplest form consists of printing new money that is then used to buy US debt, called Treasuries. The Fed has made a myriad of claims for why it did this (to help housing, the help the economy, etc.) but the blunt reality is that this policy was primarily a means of financing the US deficit, which swelled in the post-2008 period as the public sector expanded rapidly in an effort to pick up the economic slack in the private sector.

The US went into the 2007-2008 Crisis with a national debt of $5 trillion and unfunded liabilities (Medicare, social security) somewhere in the ballpark of $50 trillion. And as the debt ballooned in the post-2008 era due to Government spending, it became more and more important for the Fed to maintain low rates: any increase in interest rates would mean much larger interest payments on a rapidly growing debt load.

This is why the Fed has maintained near zero interest rates as the US nati0nal debt swelled to $16 trillion. It’s also why the Fed continues to engage in QE despite the clear evidence over the last four and a half years that it is not an effective tool for stimulating economic growth or a rise in employment.

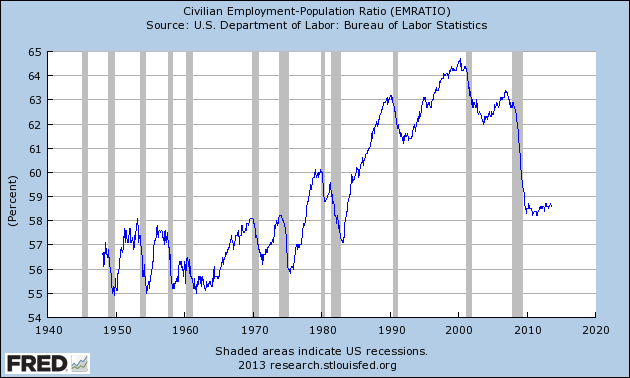

Regarding this latter point, I want to draw your attention to the labor participation rate below. The official unemployment rate is highly charged politically as it is used by the media to gauge how well a particular administration is doing at generating job growth.

As such the unemployment numbers are routinely massaged to the point of no longer reflecting the true number of unemployed Americans. For this reason, I prefer to use the labor participation rate when gauging the health of the US jobs markets: this metric represents the number of Americans who are currently employed as a percentage of the total number of Americans of working age.

As you can see, the number of employed Americans of working age peaked in the late ‘90s. It has since fallen to levels not seen since the early ‘80s. Moreover, looking at this chart it is clear that job creation has failed to keep up with population growth.

This negates any claims of “recovery” in the jobs market.

In particular, I want to draw your attention to the last five years of this chart below. The US Federal Reserve began its first QE program, called QE 1, in November 2008. Since that time it has launched three other such programs, spending over $2 trillion in the process.

During this period, the labor participation rate has not once experience a sustained uptrend. Put another way, job creation has never outpaced population growth to the point of creating a significant turnaround in the jobs market. This has happened despite the recession officially “ending” in mid-2009.

The evidence here is clear. QE does not generate jobs in the broad economy.

Best Regards

Phoenix Capital Research