The last 12 months has seen a sharp shift in tone regarding criticism of the Fed. Up until 2014, the mainstream financial media’s view of the Fed and its policies was that they had saved the financial system in 2008 and generated an economic “recovery.”

Anyone with a working brain knew this was bogus: you cannot solve a debt crisis by issuing more debt. But because the financial media makes its money from financial firms’ advertising Dollars, it (the media) was happy to promote the narrative that the Fed was omniscient and expertly adept at managing the economy.

Then things began to change.

First in the summer of 2014, Congress moved to introduce new oversight of the Fed’s policies, particularly regarding its control of interest rates.

Then the Fed was ensnared in a “leak” scandal indicating it had been providing insider information to key individuals before the public (the Fed has been leaking information for years… but the fact it became common knowledge was new).

And then a growing number of commentators began to point out that the Fed’s QE programs didn’t actually do anything for the general economy, but did increase wealth inequality.

It is this last item that has proven to be the most problematic for the Fed… particularly now that the markets are collapsing with interest rates already at zero.

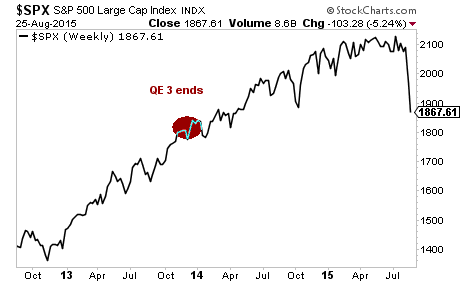

The Fed has openly stated that QE was a success because it pushed stocks higher. However, it’s hard to swallow this when stocks erase ALL of their post-QE 3 gains in a matter of four days.

In simple terms, the market collapse of the last week has proven point blank that the Fed’s theories are bogus and not based on reality. Moreover, now that the financial media has begun to promote the narrative that QE creates wealth inequality, any new QE program would be seen as a bailout of the wealthy.

This means the Fed will be unable to directly intervene to prop the markets up. We get evidence of this from the fact that NO Fed officials appeared yesterday to provide verbal intervention for the markets.

Every other time the markets has broken down in the last six years, a Fed President appeared to talk about some new policy to prop the markets up.

NOT THIS TIME. The Fed’s silence signals that things have changed in a big way. Smart investors should start preparing now. This mess is not over by any stretch.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets: we just closed TWO new double digit winners yesterday.

This brings us to a TWENTY NINE trade winning streak… and 35 of our last 36 trades have been winners!

Indeed… we’ve only closed ONE loser in the 12 months.

You can try Private Wealth Advisory for 30 days (1 month) for just $0.98 cents

During that time, you’ll receive over 50 pages of content… along with investment ideas that will make you money… ideas you won’t hear about anywhere else.

To take out a $0.98 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research