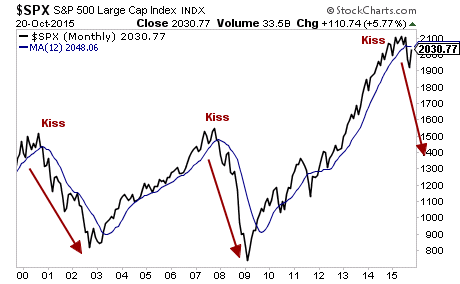

The markets are surging this morning based on hype and hope of more QE from Central Banks. This view is overlook the fact that EVERY collapse follows a pattern:

1) The initial drop

2) The bounce to “kiss” former support

3) The real implosion.

We’ve passed #1 and are in the middle of #2. Next up is #3.

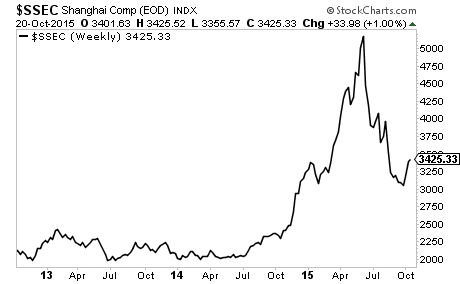

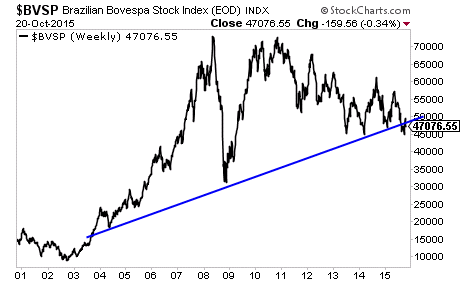

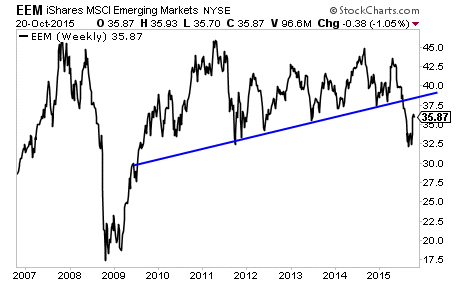

Abroad, the damage has been even worse with China, Brazil, and the Emerging Market complex as a whole imploding.

China’s stock bubble has burst.

Brazil has taken out its bull market trendline.

Brazil has taken out its bull market trendline.

As have the Emerging Markets as a whole.

As have the Emerging Markets as a whole.

The hype and hope of more QE misses the point…

The bull market of the last six years is over.

We will get bounces, like the one that has occurred in the last two weeks. But the trend is now down.

Already investors have begun to realize that Central Banks have lost control of the markets. This is why they erased months’ worth of gains in four days’ time.

Indeed, at this point, it looks as though the END GAME has begun, ushering in a crisis that will make 2008 look like a joke.

Smart investors are preparing now, BEFORE it hits.

If you’re looking for actionable investment strategies to profit from this trend we highly recommend you take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter that can help you profit from the markets.

Indeed, while other investors are getting whipsawed by the markets…we’ve just locked in two more winners, bringing our winning streak to 35 straight winning trades!

All told 40 of our last 41 trades MADE MONEY.

However, I cannot maintain this track record with thousands upon thousands of investors following these recommendations.

So tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

To lock in one of the remaining $0.98 slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research