The world has yet to fully digest what is currently happening in Japan.

Japan is the global leader for Keynesian Central Banking insanity. The ECB and US Federal Reserve began implementing ZIRP and QE after 2008. The Bank of Japan has been employing both ZIRP and QE since 2001.

Put simply, by the time the Great Crisis of 2008 rolled around, the Bank of Japan had nearly a decade’s experience seeing what QE, ZIRP, and the like could accomplish.

On top of this, the Bank of Japan has been the single most aggressive Central Bank post-2008. In 2013, it launched a single QE program equal to roughly 25% of Japan’s GDP (the Fed’s largest program was less than 10% of GDP).

As if this wasn’t insane enough, the Bank of Japan then expanded the program, not because it was working, but because doing so would result in its models appearing more accurate.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 17% year to date.

Over the same time period, the S&P 500 DOWN 8%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 25%… and the year only just started!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

In short, the Bank of Japan crossed the Rubicon long ago as far as monetary insanity goes.

Which is why it’s critical to note two things:

- The Head of the Bank of Japan, Haruhiko Kuroda has admitted Japan’s “potential” GDP growth is 0.5% or less.

- The Bank of Japan just boosted its ETF purchases but not its bond purchases in response to Japan re-entering a recession.

Regarding #1, this is an implicit admission that QE doesn’t generate GDP growth. Anyone who’s studied QE knew this already, but it’s an incredible admission from a Central Banker. These are the people responsible for instilling confidence in the system.

Which brings us to #2.

The illusion that QE is anything other than a market prop is over. The BoJ has admitted QE doesn’t generate economic growth. This is confirmed by the fact that it only boosted the stock related component of its current QE program, NOT the bond-buying component.

Mind you, this is AFTER Japan entered a recession, which only gives credence to Kuroda’s admission that QE cannot generate GDP growth.

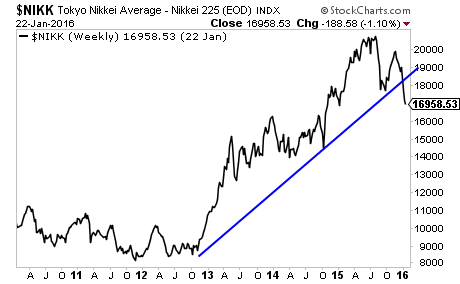

However, the big news is that despite the boost in ETF purchases, Japan’s Nikkei has collapsed, taking out the bull market trendline running back to the first hint of Abenomics back in late-2012.

In short, not only has the Bank of Japan admitted QE is not a successful tool for boosting GDP, but we’ve reached the point at which even increases in QE are no longer having the desired effect

The markets have yet to digest this, but when they do, it’s going to be one heck of a show.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 65 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research