As we outlined last week, the bursting of the bond bubble has begun.

CNBC and the financial media may spend 99% of their time talking about stocks, but bonds are the single most important issue for Central Banks.

When you consider everything in the context of the bond bubble, every Central Bank policy begins to make sense.

- Central Banks cut interest rates to zero to make bond payments smaller.

- Central Banks launched QE and other programs to put a floor beneath bond prices (when bond prices rise, bond yields fall and debt payments become smaller and easier to service).

- Central Banks provided verbal intervention promising to do “more” or “whatever it takes” whenever bonds came close to ending their bull market.

None of these issues address what created the bond bubble in the first place. So global governments, corporations and others took advantage of low interest rates to issue… more debt.

In 2008 the bond bubble was $80 trillion in size. Today it’s $100 trillion. Put simply, the financial system is even more leveraged today than it was in 2008.

And the bond bubble just burst.

Today corporates are more leveraged than they were in 2007. Thus, the Bond Bubble not only encapsulates sovereign nations, but even individual companies. And now that bubble is bursting.

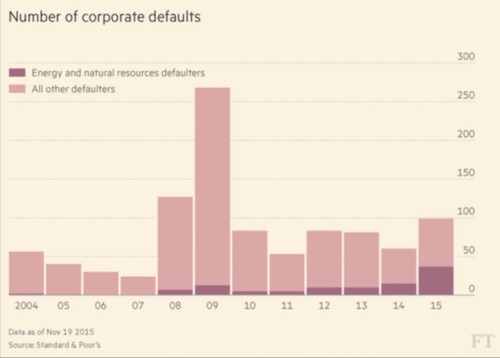

Companies have defaulted on $95bn worth of debt so far this year, with 2015 set to finish with the highest number of worldwide defaults since 2009, according to Standard & Poor’s.

The figures are the latest sign financial stress is beginning to rise for corporate borrowers, led by US oil and gas companies. The rising tide of defaults comes as investors reassess their exposure to companies that borrowed heavily in recent years against the backdrop of central bank policy suppressing interest rates…

Based on the number of defaults in the first three quarters of the year, S&P expects 109 defaults by year-end, the largest total since 268 borrowers ran into problems in 2009. There were only 60 defaults worldwide in 2014.

Source: Financial Times

The first sector to go belly up was energy, due to the collapse in Oil prices started mid-2014.

———————————————————————–

The Single Best Options Trading Service on the Planet

Our options service THE CRISIS TRADER is absolutely KILLING it.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades.

Even if you include ALL of our losers, we are up 17% year to date.

Over the same time period, the S&P 500 DOWN 8%.

That’s correct, with minimal risk, we are outperforming the S&P 500 by 25%… and the year only just started!

Our next goes out tomorrow morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30 day trial subscription to THE CRISIS TRADER…

———————————————————————–

However, as the below chart shows, this is much more than an Energy bust:

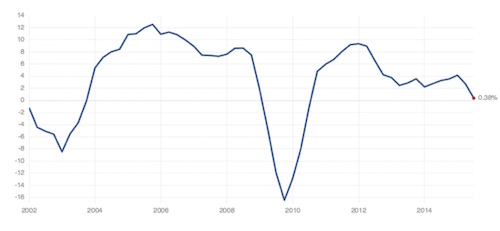

This wave of defaults be increasing as the global economy weakens. Year over Year corporate sales growth is already flatlining and trending down.

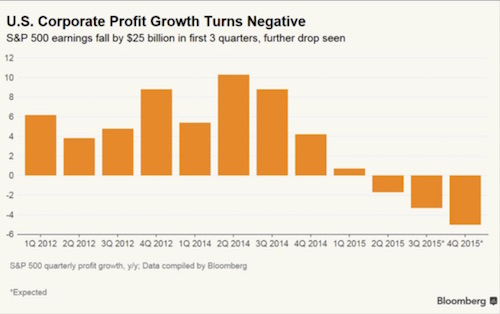

Energy is the worst performer from a sales perspective, but it is hardly alone. Materials, Industrials, Technology, and Utilities are all posting negative growth resulting in overall negative sales growth for the S&P 500. And we’ve reached the point that even financial engineering via buybacks is failing to mask the fact that profits are falling:

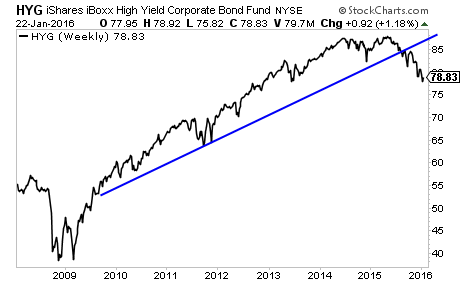

As a result of this, money is flowing out of corporate bonds, particularly junk bonds. Last year (2015) was the first year since 2009 that Junk Bonds finished DOWN for the year.

That bubble has now clearly burst.

This is just the beginning. The bond bubble will take months to completely implode. And eventually it will consume even sovereign nations.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory is a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research