The world has not yet full realized the magnitude of the slowdown in China.

The “official” China growth numbers claim the Chinese economy is plowing along at 6%. I use quotations around the word “official” because Chinese economic data points are complete fiction.

Indeed, back in 2007, no less than current First Vice Premiere of China, Li Keqiang, admitted to the US ambassador to China that ALL Chinese data, outside of electricity consumption, railroad cargo, and bank lending is for “reference only.”

Let’s take a look at China’s self-admitted more accurate economic data points then.

According to the State Council’s National Development and Reform Commission China’s electricity consumption grew at 3.2% in the 1Q16. This represents growth that is a full 50% LOWER than the “official” China headline GDP growth numbers.

That’s the best part…

According to Qiao Baoping, chairman of China Guodian Corp, China has overcapacity of 20%. Baoping believes China will see a DECREASE in electricity consumption this year. This comes after last year’s decline in electricity generation: the first such fall in DECADES.

Beyond electricity consumption…

———————————————————————–

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 300% return on invested capital thus far in 2016.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER

———————————————————————–

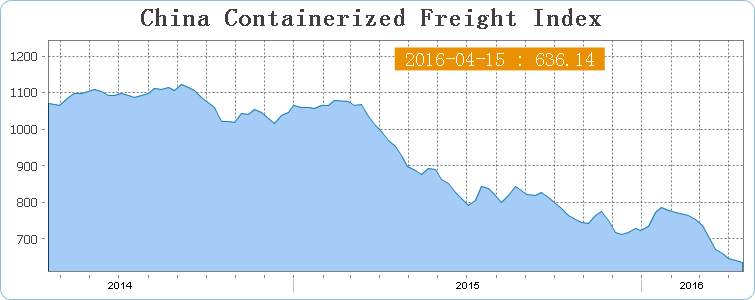

Consider that Chinese freight index just collapsed to a record low. If China’s economy was chugging along at 6% or more… how is it that the volume of freight being shipped from China collapsed nearly 50% in the last two years?

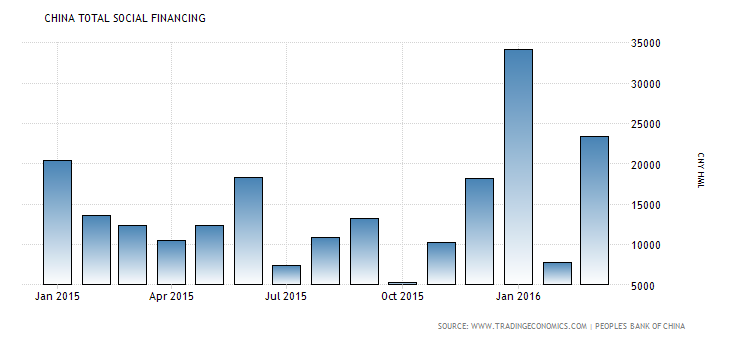

The one prop holding up China’s economy is its rampant Credit Growth. Indeed, as ZeroHedge noted recently, China has pumped over $500 billion in credit into its economy thus far in 2016:

This represents an amount equal to nearly 7% of China’s GDP in credit expansion… in THREE MONTHS.

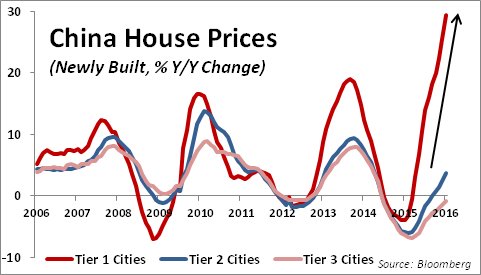

This insane money printing has generated no shortage of bubbles, the most notable of which is in property prices:

If this whole mess feels like 2007-2008 all over again, you’re right. Once again we have Oil and commodities spiking higher on hopes of China’s growth and Central Bank policy (more money printing). Meanwhile, the global economy is contracting, lead by a slowdown in China which is growing at 4% at best and likely flat-lining.

Remember, the farther and farther the markets get away from fundamentals, the worse the Crash will be.

Indeed, I’ve already alerted subscribers of my Private Wealth Advisory newsletter to two plays that resulted in gains of 11% and 41% in just six week’s time from the market’s volatility.

This is nothing new for us, in the last 17 we’ve closed out 77 straight winning trades.

Did I say, “77 straight”winning trades”?!?

Yes, I did.

For 16 months, not only have Private Wealth Advisory subscribers locked in 75 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

And I’ve got three more winners (#’s 78, 79, and 80) on deck as I write this.

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

77 closed winners… and not one closed loser… in 17 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (Monday) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit