In the US economy is most assuredly moving into, if not already in a recession.

The media trumpeted the amazing 2.0% growth rate initially forecast for the first quarter of 2016. That forecast has since collapsed to 0.3%. This is the same game Government beancounters have been playing for years: a great initial forecast that is then revised lower and lower.

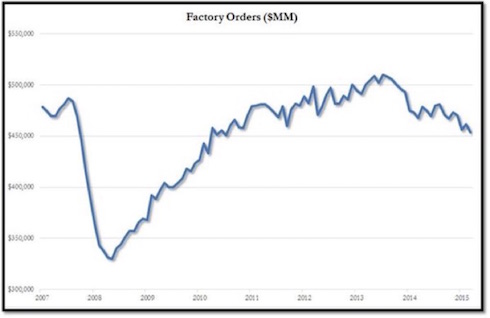

The above suggest the US economy is flatlining. However, other data are far worse. We’ve seen 16 straight months of declines in Factory Orders (this never happens outside of recessions)

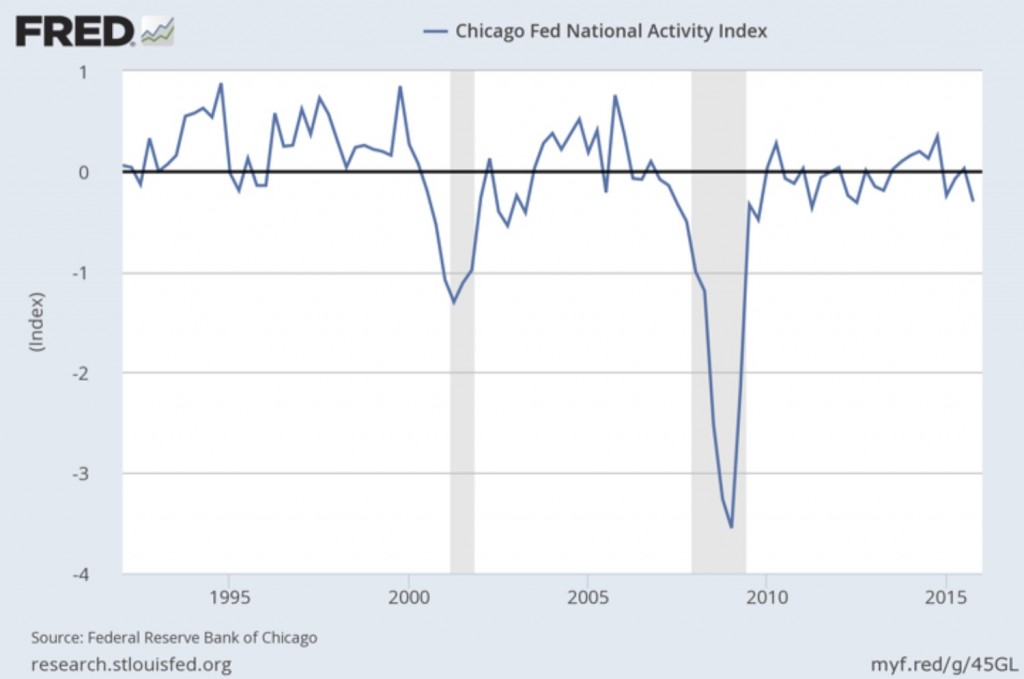

Also, the Chicago Fed National Activity Index is rapidly deteriorating:

All of these data points indicate the US economy is likely flat-lining if not contracting into a recession.

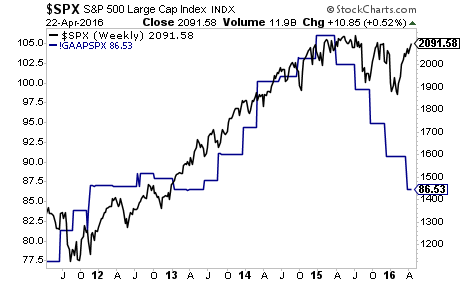

Meanwhile, stocks are in the single largest bubble in the last 100 years. Look at the MASSIVE gap between the S&P 500 and EPS!

The time to prepare for this bubble to burst is now. When stocks catch up to earnings, we’re going DOWN, possibly even in a CRASH.

Indeed, I’ve already alerted subscribers of my Private Wealth Advisory newsletter to two plays that resulted in gains of 11% and 41% in just six week’s time from the market’s volatility.

This is nothing new for us, in the last 17 we’ve closed out 77 straight winning trades.

Did I say, “77 straight”winning trades”?!?

Yes, I did.

For 16 months, not only have Private Wealth Advisory subscribers locked in 77 CONSECUTIVE winners including gains of 18%, 36%, 69%, even 119%...

And I’ve got three more winners (#’s 78, 79, and 80) on deck as I write this.

But more importantly, throughout that ENTIRE TIME we’ve not closed a SINGLE loser.

77 closed winners… and not one closed loser… in 17 months.

Based on what’s happening in the markets today, we’ve decided to extend our deadline on our current offer to try Private Wealth Advisory by another 24 hours.

So tonight (Monday) at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Our FREE e-letter: http://gainspainscapital.com/

Follow us on Twitter: http://twitter.com/GainsPainsCapit