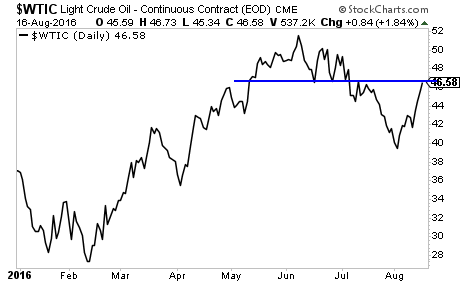

Oil is slamming up against resistance.

The odds favor a correction here, probably to the $38-39 area.

This, in turn, would drag on stocks. $38 Oil would pull the S&P 500 to the mid-2000s (probably 2,040).

At that point it’d be time to reassess the markets. The fact is that this rally has come too far too fast. The odds favor at least a 5% if not a 10% correction here.

If you’re looking for investment strategies to profit from this, I can help you…

Because I am usually warning about risks in the market, everyone assumes I’m nothing but a bear who has his clients shorting the heck out of the market all the time.

Pointing out the risks to the stock market is very different from actively shorting it. The editorial I publish here is focused on alerting EVERYONE about the problems the financial system faces.

However, when it comes to active investment strategies… I do see opportunities to short… but I also see opportunities to go long.

Case in point, thus far in 2016 Private Wealth Advisory subscribers have made a killing shorting European banks while also being long various mining companies.

As a result of this, we’re now at 98 STRAIGHT WINNING TRADES.

Indeed, we haven’t closed a single loser since November 2014.

98 straight winners… and not one closed loser… in 20 months.

We take a careful and calculated approach to investing… which is how we’ve been able to maintain this incredible streak of winners… despite market conditions that can be described as “challenging” at best.

You can join us today by taking out a 30 day trial subscription to Private Wealth Advisory for just $0.98.

If you find Private Wealth Advisory is not what you’re looking for just drop us a line and you won’t be charged another cent.

To take out a 30 day trial subscription to Private Wealth Advisory for just $0.98…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research