Minneapolis Fed President Neel Kashkari wants us to believe that the Fed is not a political entity.

Kashkari is either ignoring reality or simply providing cover for the single most political Fed in history. This is not a Left vs. Right issue, this is an establishment vs. legitimate reform issue.

Consider 2012. Supposed “Republican” Ben Bernanke launched QE 3 as a clear gift to the Obama administration’s re-election bid. The data didn’t warrant another QE program in any way. Moreover, the Fed was already engaged in Operation Twist at the time.

———————————————————————–

The Single Best Options Trading Service on the Planet

THE CRISIS TRADER has produced an astounding 37% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 240% thus far in 2016.

Our next trade goes out this morning… you can get it and THREE others for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

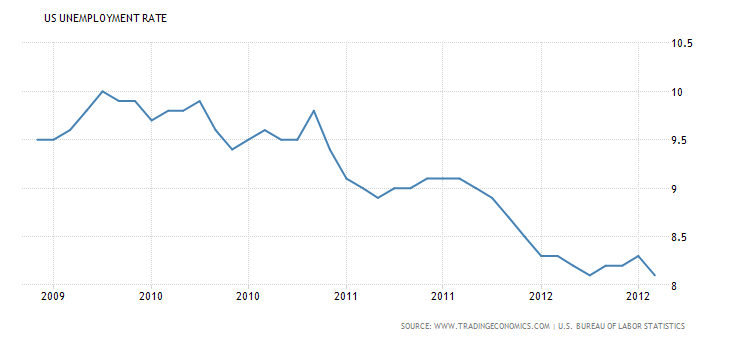

Unemployment had declined steadily since the 2009 recession ended.

GDP growth rate had bumped higher from the 2011 dip.

Again, there was no real justifiable reason for the Fed to launch another QE program, let alone an open ended one. This was a clear gift from a Fed Chairman to a sitting President regardless of political party affiliation.

Today the politicization is even more obvious. We have Fed Governors openly contributing to Presidential candidate’s campaigns. And Janet Yellen met privately with President Obama in April 2016.

The official reason for this was to discuss “the economy and income inequality” but anyone with a functioning brain knows Obama was giving Yellen her marching orders to prop the markets up until the November election.

Why would two issues that have been in place since 2009 suddenly warrant the first private one on one meeting in 18 months… a mere eight months before Obama leaves office?

Again, the Obama Yellen meeting in April was very likely to put an election year fix in place in the markets. I and others have commented that since that meeting “someone” has very clearly been stepping in to defend the markets any time they take a nose-dive.

Every time this occurs the buying is both urgent and indiscriminate= the hallmarks of manipulation. REAL buyers do NOT panic buy billions of dollars worth of futures in a 1-minute span.

Again, the Fed is indeed a political entity. And this particular Fed is the single most political Fed in history. This is not about Left vs. Right, this is about maintaining the current political/financial power structure in the US at all costs.

If you’re looking for investment strategies to profit from this, I can help you…

Case in point, thus far in 2016 Private Wealth Advisory subscribers have made a killing shorting European banks while also being long various mining companies.

As a result of this, we’re now at 107 STRAIGHT WINNING TRADES.

Indeed, we haven’t closed a single loser since November 2014.

107 straight winners… and not one closed loser… in 20 months.

We take a careful and calculated approach to investing… which is how we’ve been able to maintain this incredible streak of winners… despite market conditions that can be described as “challenging” at best.

You can join us today by taking out a 30 day trial subscription to Private Wealth Advisory for just $0.98.

If you find Private Wealth Advisory is not what you’re looking for just drop us a line and you won’t be charged another cent.

To take out a 30 day trial subscription to Private Wealth Advisory for just $0.98…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research