By continually moving its “targets” for political purposes, the Fed has let the inflation genie out of the bottle.

The Fed should have begun raising rates back in 2012. However, instead of doing this, then-Chairman Ben Bernanke gifted the Obama administration QE 3: an open ended QE program.

The goal was to boost the economy to help the Obama administration with its reelection bid. This is not a right vs. left issue (Bernanke was allegedly a Republican), this was simply an issue of the Fed taking its cue from the political/ financial elite in the US to maintain the status quo.

After the election, the Fed then claimed it would start to raise rates when unemployment fell to 6.5%. The US economy hit that target in April 2014.

However, there was a Congressional election that year. And the Fed once again held off raising rates.

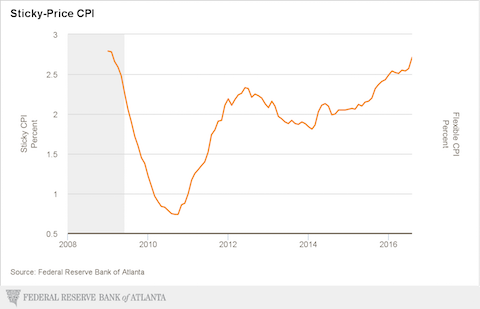

Meanwhile, sticky inflation cleared the Fed’s target of 2%.

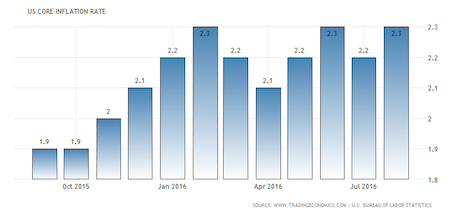

Since that time, core inflation has also cleared the Fed’s 2% target rate. It did this 11 months ago.

The inflation genie is out of the bottle. Gold has figured this out and will be moving to $1500 if not higher in the next year.

To that end, Private Wealth Advisory subscribers just opened SIX new inflation trades to profit from the Fed’s mistake.

As I write this, ALL SIX OF THEM ARE ALREADY UP.

Seriously at this point, if you’re not taking out a trial subscription to our Private Wealth Advisory newsletter, I don’t know what else to tell you.

First of all, 109 of our last 111 trades were WINNERS.

That is not a typo. We’ve only closed TWO losers in the last TWO YEARS.

This is a record in investing, a winning rate of 98% over a 24 month period.

In September alone we’ve closed WINNERS of 6%, 8%, 11%, 14% and 19%.

If you don’t believe me, you can take out a trial for 30 days for 98 cents.

If you find Private Wealth Advisory is not what you’re looking for, simply email us and you won’t be charged another cent.

However, I have no doubt you, like our other subscribers will stay with us. Most subscribers make enough money on a single one of our trades to cover the cost of an entire YEAR’S subscription (just $199).

Indeed, less than 10% of subscribers choose NOT to stay with us. And the ones that DO cancel do so because they’re simply not active investors and prefer owning a single mutual fund.

I know you’re not that kind of investor. You’re looking for regular market crushing gains and minimal losers to grow your capital like a rocket ship.

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

PS. I almost forgot, a 30 day trial subscription to Private Wealth Advisory for just 98 cents comes with SIX SPECIAL INVESTMENT REPORTS.

- The Crash Trigger: The Signal That Flashed Before 1987, 2000, and 2008

- The War on Cash: the Fed’s Secret Plan to Outlaw Cash

- Protect Your Portfolio From a Crash

- Protect Your Savings from a Bank Failure

- The Inflation Secrets Your Broker Won’t Tell You About

- Bullion 101: How and Why to Buy Gold and Silver

These reports are yours to keep EVEN IF YOU CHOOSE TO CANCEL YOUR SUBSCRIPTION.

How’s that for a NO RISK offer?

To take out a 30 day trial subscription to Private Wealth Advisory for just 98 cents.