Are you worried about a market drop?

I’m not, we’ve been preparing for what’s coming for weeks.

Why do I think the markets will be dropping?

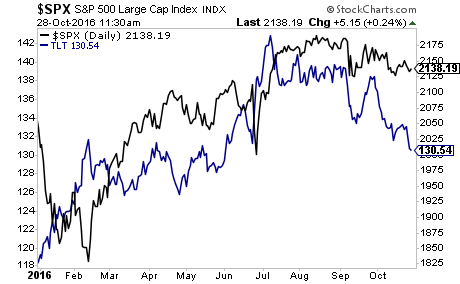

- Globally bond yields are spiking. With bond yields rising, earnings yields will follow. The only way for earnings yields to rise is for stock prices to FALL.

Long bonds lead stocks to the upside this year. They’re now leading DOWN.

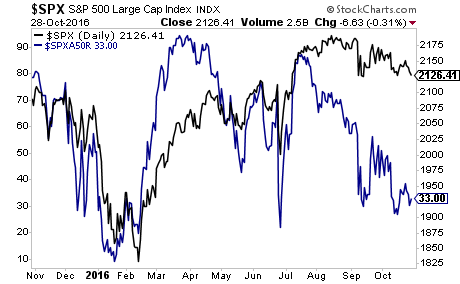

- The market is being held up by just 5-6 stocks.

The number of individual companies above their 50-day moving averages has been in a virtual free-fall since February. Literally a handful of companies remain strong. Everything else is breaking down.

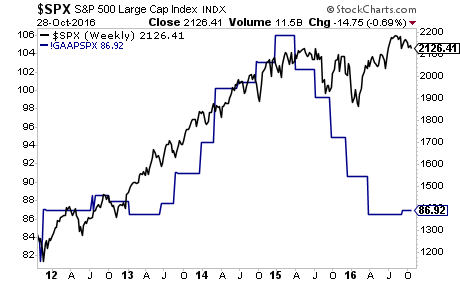

3) Earnings have already collapsed to 2012 levels.

At the end of the day, investors buy stocks for earnings. But earnings have already collapsed to levels not seen since 2012.

Stocks would need to CRASH over 25% to below 1,500 just to catch up.

Bond yields spiking? Stock internals in a free-fall? Earnings in a severe collapse?

This has the makings of a financial crisis. The whole mess is starting to feel a LOT like 2008 again.

The time to prepare is now.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you cThe an use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 70 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare2.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research