What is Janet Yellen thinking?

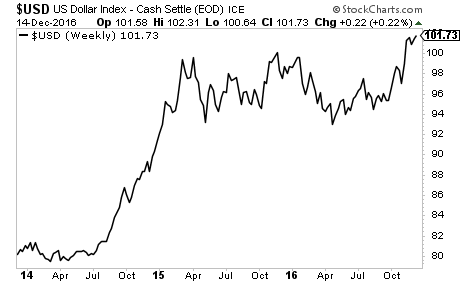

As the Fed wound down its QE program in 2014, the $USD hit liftoff. It has since hovered in the mid- to upper-‘90s.

Throughout this period, anytime the $USD began to move sharply higher one of more Fed officials appeared to “talk down” the $USD.

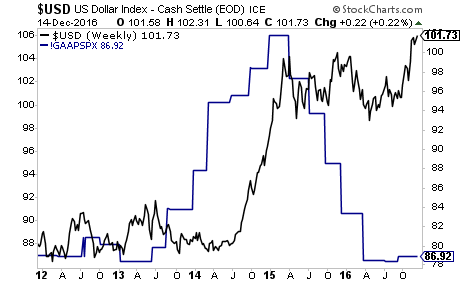

The reasoning here is simply. A strong $USD crushes corporate profits. Indeed, since the $USD began its bull market S&P 500 earnings have collapsed to 2012 levels.

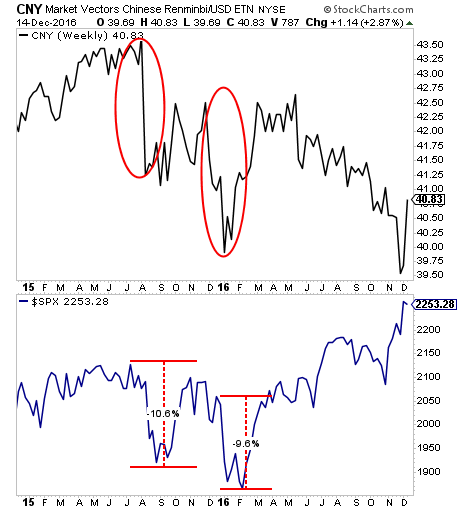

A strong $USD also asks for trouble from China. It was the strong $USD that forced China to devalue the Yuan in August 2015 and again in December 2016… both of these times, US stocks collapsed 10% in the span of a few days.

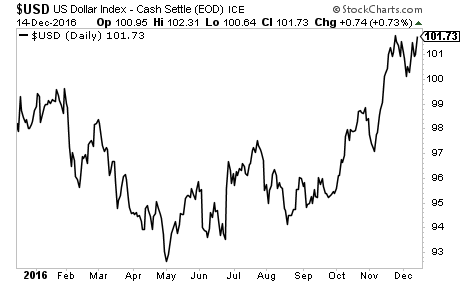

Having said all of this… in the last month the $USD has erupted above 100 and the Fed hasn’t said a word.

Worse than this, the Fed raised rates again yesterday and has predicted THREE more rate hikes in 2017.

The Fed is doing this when the $USD is already at a 13 year high!?!?

The Fed is playing a very dangerous game both with China and with the markets. I wouldn’t be surprised to see a VERY aggressive Yuan devaluation in the next few weeks.

And it’s going to trigger a market meltdown just as it did in August 2015 and January 2016.

THIS WILL HIT BEFORE THE END OF JANUARY.

Another Crisis is brewing… the time to prepare is now.

Based on this situation… we’ve decided to extend our offer to explore Private Wealth Advisory for 30 days for just $0.98.

We don’t want investors to miss out on the potential to turn this market volatility into profits. Private Wealth Advisory have a success rate of 89% with our trades (meaning we make money on nearly 9 out of 10 positions).

But we cannot maintain this track record with thousands of traders following these picks.

Tonight at midnight we’re closing the doors on our offer to explore Private Wealth Advisory for 30 days for just $0.98.

But this is IT. No more extensions.

If you want to lock in one of the remaining slots, you better move quickly.

To lock in one of the last $0.98 30 day trials to Private Wealth Advisory…

Graham Summers

Chief Market Strategist

Phoenix Capital Research