To skip this article and receive FOUR highly targeted trades designed to grow your portfolio dramatically… Click Here Now!

The stock market is now officially a political tool.

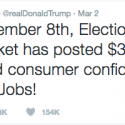

The Trump White House has made it clear that it views the stock market as a “report card” on Trump’s policies.

Regardless of whether or not you like Trump is irrelevant. The reality is that INDIVIDUAL investors have voted with their money and in massive way, piling into stocks at a pace we’ve not seen since 2014.

Source: Zerohedge

Since election night, investors have put MORE money into stocks than they did throughout ALL of 2015. A whopping $8.2 billion piled into stocks in a single day just last week.

This means that stocks are now a “mom and pop” investor item in ways we’ve not seen since 1999. CNBC and friends like to talk about stocks as it everyone owns them, the reality is that the American public only gets heavily and directly involved in the stock market on RARE occasions (most Americans own stocks indirectly via retirement funds, only rarely do they actually move their own money into a brokerage account and then buy stocks themselves).

Indeed, the last time that individual Americans got involved in stocks in the manner in which they have since election night was in the late ‘90s during the Tech Bubble.

What does this mean?

The stock market is now a massive political tool. Any collapse in stock prices will be seen as directly impacted Americans who committed to an investment class (albeit at nosebleed valuations).

This is why Trump keeps tweeting about the stock markets. He knows Americans are now betting directly with their money. And if the market collapses… the political fallout for who “caused it” (not Trump) will be massive.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Heck earlier this week, we just closed out an 18% winner this morning.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Chief Market Strategist

Phoenix Capital Research