Today the Fed hiked rates for the third time in eleven years.

In so doing it has confirmed what many have long suspected: that the only thing that matters to the Fed is stock market levels.

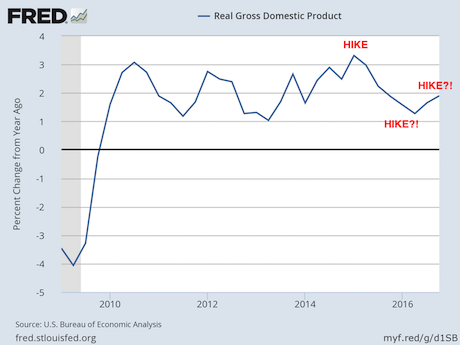

The Fed certainly doesn’t care about GDP growth. If it did, it would be evident that now is NOT the time to be hiking rates.

Let’s take a look.

Last quarter’s GDP growth was abysmal at 1.8%. Since that time the Fed’s own GDP model has collapsed to just 0.9%. Look at the below chart and tell me you think it warrants two rate hikes in a three month period. We’re talking about a 2.5% GDP collapse in the space of six weeks.

By the way, this is a rosy projection. If you run 1Q17 GDP numbers using actual consumption instead of projection consumption then GDP growth is non-existent or 0%.

Moreover, a historical perspective only adds evidence that the Fed isn’t looking at GDP numbers when deciding to hike rates. The 4Q15 rate hike makes sense… but 4Q16 and now again in 1Q17?! Why would the Fed want to hike twice in three months during sub-2% GDP growth!?

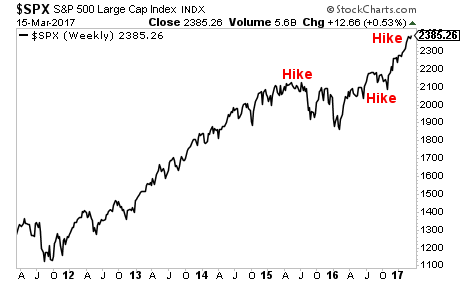

The simply answer is stock prices. When you look at a chart of the S&P 500, the 4Q15 hike makes sense. So does the decision to walk back additional hikes in 2016 (since the markets collapsed).

Now that the markets are once again roaring, the Fed has decided it’s time to start hiking again. And so it’s hiked twice in three months to attempt to deflate the stock market bubble.

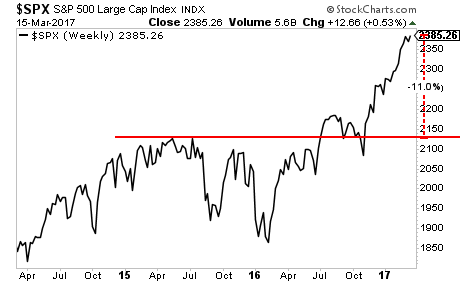

The only problem with this is that stock bubbles don’t deflate easily. Usually they collapse in a big way. This time will be no different. We’ve got air pockets all the way down to 2,125 on the S&P 500.

If you’re looking for active real time “buy” and “sell” alerts to help you make money from the markets I strongly urge you to take out a 98 cent trial to my Private Wealth Advisory newsletter.

Private Wealth Advisory is a weekly investment advisory that tells investors what stocks and ETFs to buy and sell… and when to do so.

Does it work?

A full 86% of our investments made money in the last 26 months. Yes, 86%, meaning we make money on more than 8 out of 10 closed positions.

Currently our portfolio is chock full of winners too, including gains of 10%, 12%, 15%, 25% even 33%.

Just yesterday we closed out two more winners of 8% and 9%.

Best of all, you can explore Private Wealth Advisory for 30 days for just $0.98.

To do so…

Graham Summers

Chief Market Strategist

Phoenix Capital Research