Janet Yellen is playing with matches next to a $20 Trillion Debt Bomb.

During her speech at the Gerald R. Ford School of Public Policy in Michigan, Yellen stated that the biggest risk to monetary policy is for the Fed to “get behind the curve” regarding inflation.

To that end, the Yellen Fed has already raised interest rates twice in the last six months. And it is pushing for yet another rate hike in June.

However, Yellen as usual is missing the bigger issue: the risk of DEBT deflation triggered by the Fed’s rate hikes.

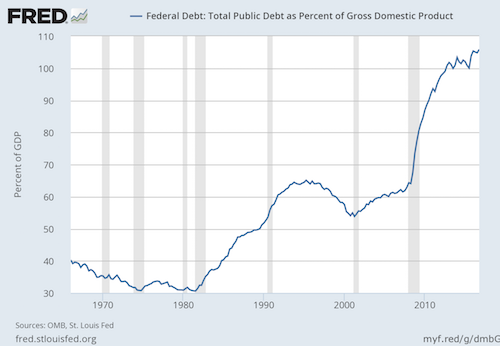

Since the 2008 Crisis, the US has been on a debt binge unlike anything we’ve ever seen before. Thanks to seven years of ZIRP and $3.5 TRILLION in QE, the US’s debt load has nearly doubled, bringing our Debt to GDP ratio well over 100%.

Now Yellen wants to raise rates even more, in her hopes of catching up with inflation…

But what happens to the US’s massive debt pile as the Fed keep’s raisings rates, making the debt MORE expensive to pay off?

In 2016, when rates were still 0.5%, the average US interest payment was already 1.9%. What happens to this when the Fed keeps raising rates, pushing the yield on the debt even higher?

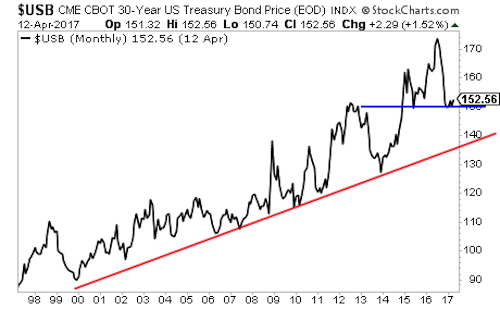

The markets are already “smelling” this.

Already the 30-Year US Treasury bond has dropped sharply to critical support (the blue line). And that’s before the Fed even raises rates in June, let alone pushes to start shrinking its balance sheet later this year.

Truth be told, we’re not that far off from a debt crisis. Greece’s Debt to GDP was 109% when it first began imploding in 2010. We’re only a hair’s breadth away from that now. And given the Fed’s track record with asset bubbles (the Tech Crash in 2000, the Housing Crash in 2008), what are the odds the Fed’s going to blow the system up once again, due to mismanagement of OBVIOUS risks?

We are already preparing our clients for how to make money from this. If you’d like to learn three simple investment strategies on how to navigate the coming US debt bomb, you can pick up a free Investment Report here:

http://phoenixcapitalmarketing.com/bondbubble2.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research