Trump is speaking… but the markets still don’t hear him.

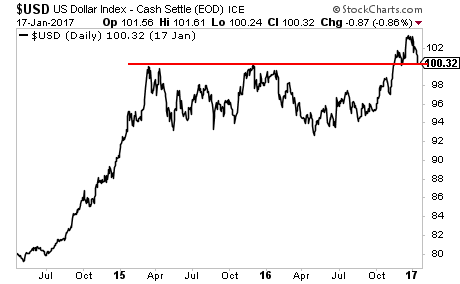

On January 17th 2017, the Wall Street Journal published an article in which Trump stated point-blank that the $USD was “too strong.”

The US currency took note, falling over 1% that day bringing it to critical support.

However, the Fed had different plans for the greenback, hiking rates in March and then promising to hike them twice more in 2017. The $USD reclaimed this line and has since maintained it.

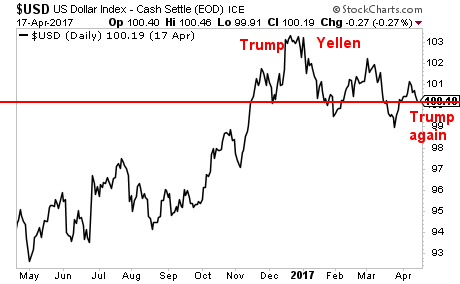

So ask, Trump struck again, this time tweeting “the US Dollar is too strong.”

Look… regardless of one’s political views here, it’s obvious Trump wants the $USD lower. And it’s also obvious that he’s trying to woo Janet Yellen to his side of this situation.

“I like her, I respect her,” Trump said, according to a WSJ published Wednesday. “It’s very early. [regarding renominating her in 2018]“

When asked about Yellen, according to the Journal, the president added: “I do like a low-interest rate policy, I must be honest with you.”

Source: CNBC

You can easily read between the lines here. Trump would like Yellen a lot more if she stopped hiking rates and maintained a “low-interest rate policy.”

In the simplest terms possible… Trump wants a lower $USD and low interest rates. And he’s going to keep pushing for both until he gets them.

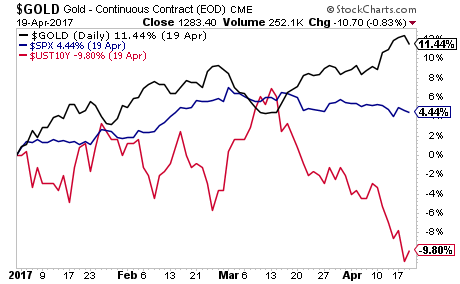

And Gold knows it too.

The precious metal has been on an absolute tear so far in 2017, crushing stocks AND bonds.

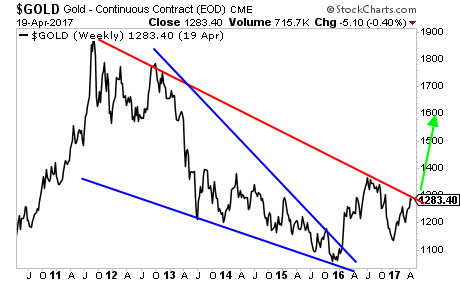

And as Trump continues to push the $USD lower, Gold will only perform even better. Once the precious metal takes out the downward sloping trendline dating back to the 2011 top, the path is clear for an eventual move to $1600 per ounce.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to a number of Gold plays that will produce triple digit winners.

Since that time EIGHT of them are already double digit winners.

And we’re just getting started.

If you need help doing this, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 85%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research