The US has hit its Debt Ceiling.

The only reason it has yet to result in a crisis is because the Treasury employed “extraordinary measures” to keep the markets functioning.

Those measures end this Friday.

Put differently, Congress now has FOUR days to resolve the budget in order to avert a debt crisis.

This is the same budget that features…

- Trump’s border wall

- Funding for sanctuary cities

- Obamacare subsidies.

Any one of those are “deal breakers” for different factions in Congress. And don’t forget that we are dealing with a situation in which various political factions will gladly torpedo legislation based on their agendas.

And these people have FOUR days to resolve the above issues…

Good. Luck. With. That.

The reality is that a Government shutdown is not just likely but highly probable. And the fact that this is occurring when the US has already hit its debt ceiling and has implemented extraordinary measures doesn’t bode well.

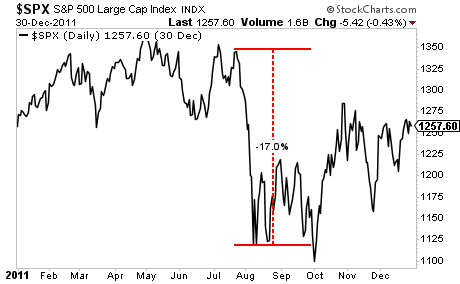

The whole mess is quite similar to the Debt Ceiling crisis of mid-2011. That particular situation resulted in stocks plummeting 17% as the US lost its AAA credit rating.

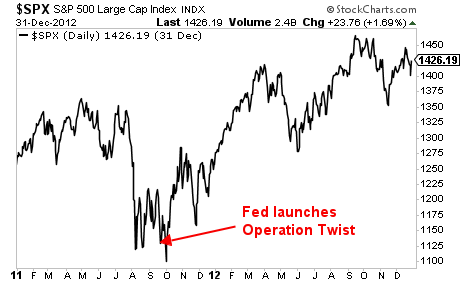

It was only through direct Fed intervention as well as the announcement of Operation Twist that stocks were able to regain their footing.

This time around the Fed is TIGHTENING policy with plans for at least two more rate hikes and the shrinking of its balance sheet sometime later this year.

So the notion that the Fed will be able to “save the day” if Congress doesn’t get its act together isn’t anywhere near as high as it was in 2011.

This opens the door to a potential market “event.” And few if any are paying attention to it.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to FIVE trades that will produce triple digit winners if Congress blows up the market.

As I write this, ALL of them are up.

And we’re just getting started.

If you’d to join us, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 86%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research