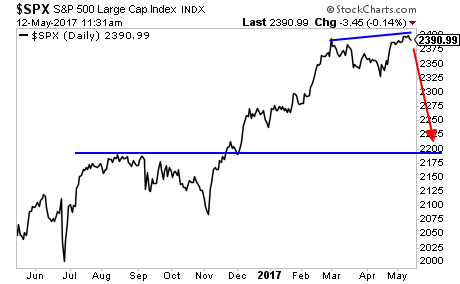

The markets are speaking, but no one is listening.

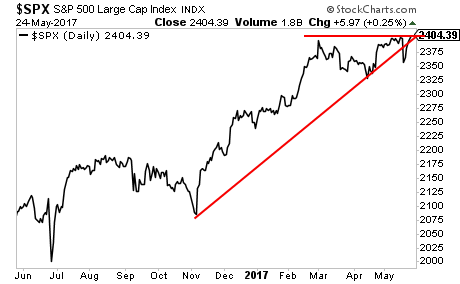

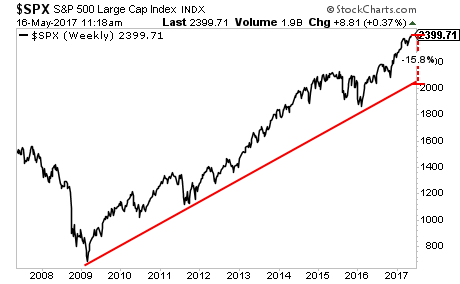

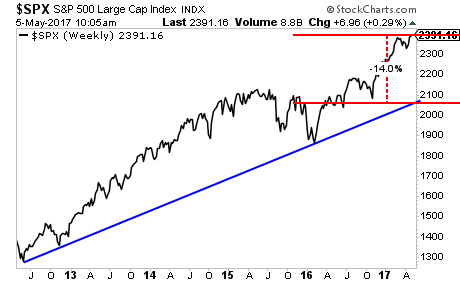

The single most important driver of the stock market since election night is the hype of a Trump-policy driven economic boom. The economy is booming, but based on expectations NOT actual policy changes.

This is a critical distinction.

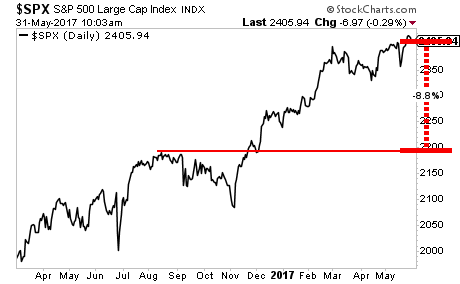

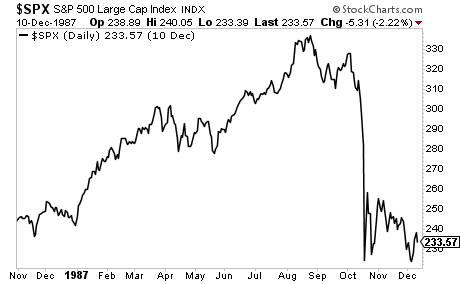

Stocks are MOST susceptible to violent drops (or even Crashes) when illusions are shattered. The illusion of major changes to the US economy is about to be shattered.

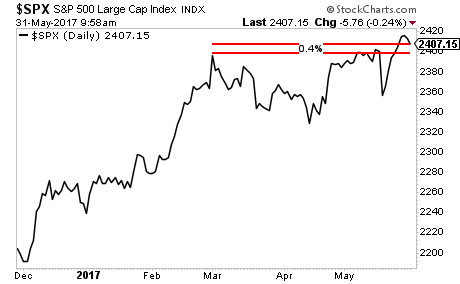

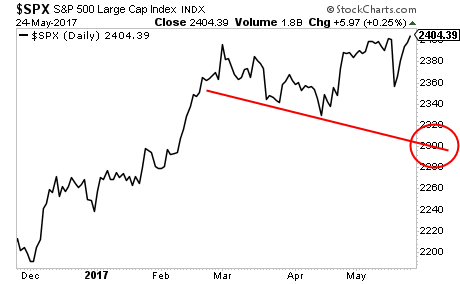

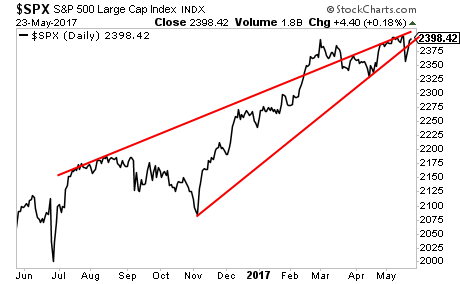

The markets are already telegraphing this.

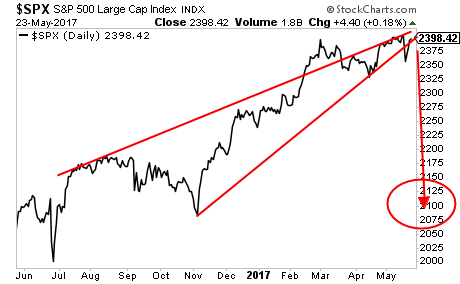

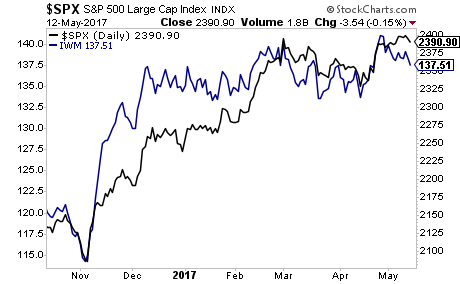

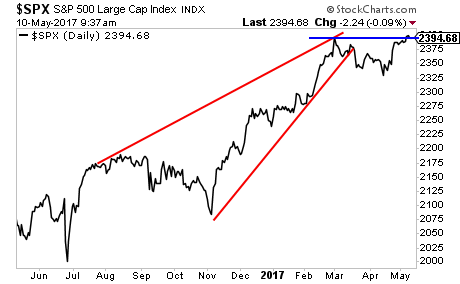

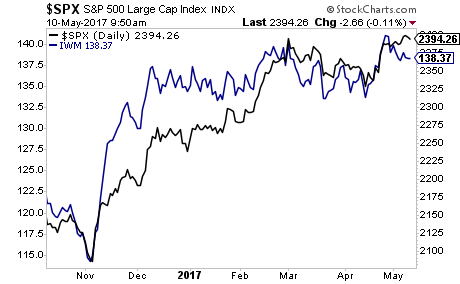

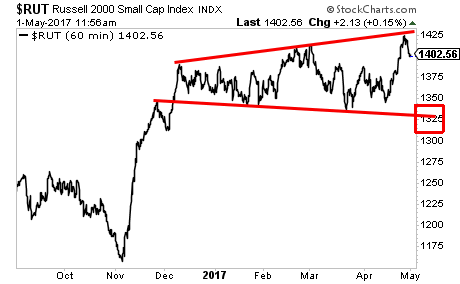

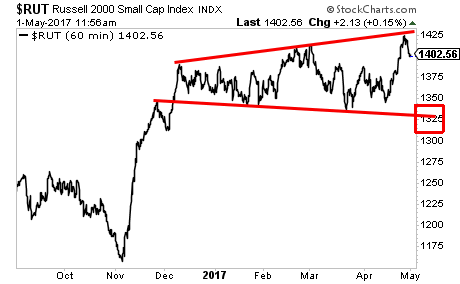

The single most important stock market index for assessing “risk on” vs. “risk off” is the Russell 2000. What the Russell 2000 does… the rest of the market soon follows.

On that note, the Russell 2000 has just staged a final blow off push to the upside. And. It. Failed. The momentum here has shifted and we could drop to that red box (a 5% drop) in a matter of days.

Put simply, this chart is telling us that the market has just entered “risk off” mode.

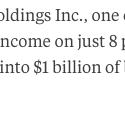

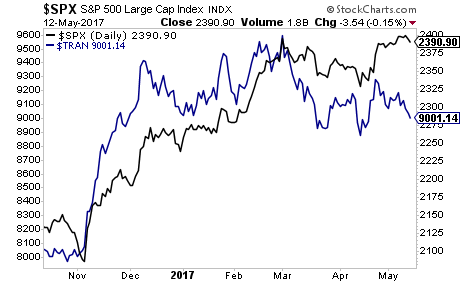

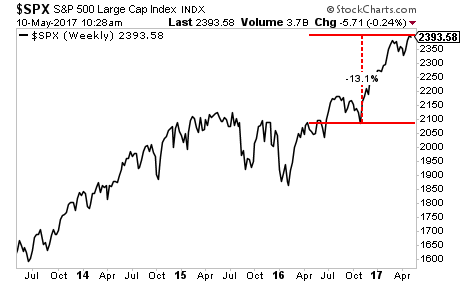

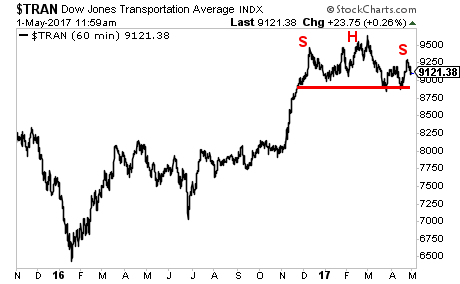

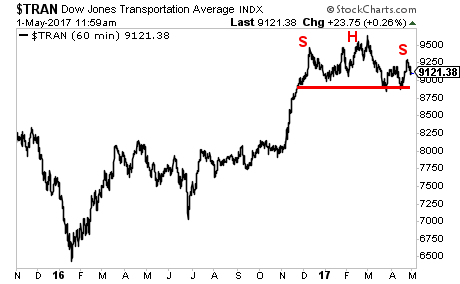

Then there’s the Dow Jones Transportation Index.

This is THE most economically sensitive index for the markets. Transports “get” the economy better than any other group of stocks.

On that note, Transports are telling us that the economy is not in fact booming… it’s basically just treading water, no matter sentiment says. In fact, we’ve got a very nasty Head and Shoulders pattern forming here.

If the economy was really roaring, Transports would be soaring. They’re not. If anything, they’re getting ready to drop 1,000 points in the next 30 days.

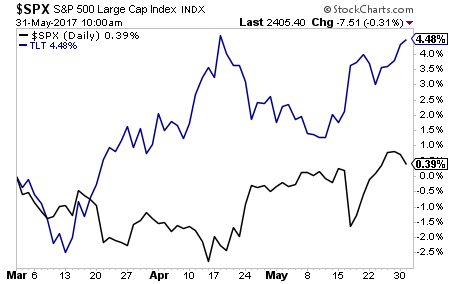

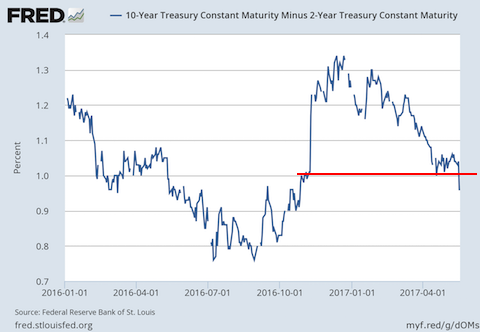

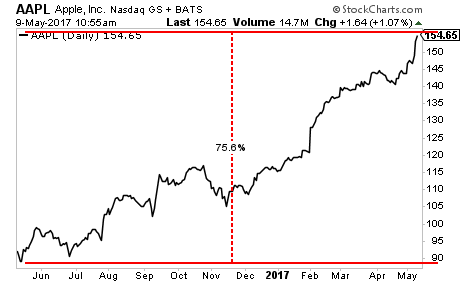

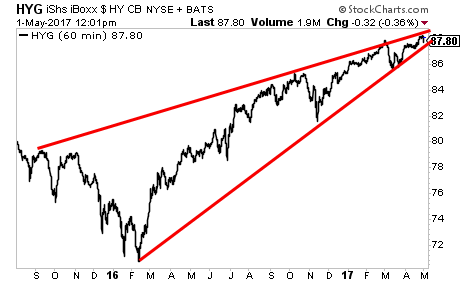

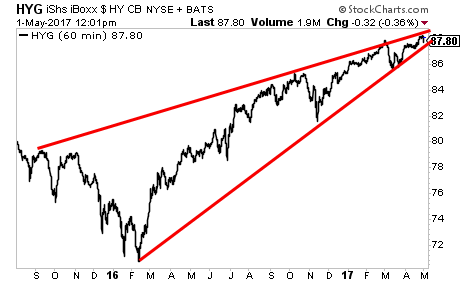

Finally, and most importantly, there is High Yield Credit or Junk Bonds. These represent the credit cycle. When credit growth is strong here, financial conditions are strengthening in the financial system and risk does well.

When credit growth is weakening, or worse, contracting here, financial conditions are worsening in the financial system and “look out below.”

On that note, Junk Bonds are rolling over and preparing to break out of a textbook perfect bearish rising wedge pattern. This is telling us that the entire move from the February 2016 bottom is about to come unraveled. We could easily see stocks drop 10% from current levels if this pattern is confirmed.

These three charts, taken together, suggest the markets are about to experience an “event” in which risk comes unhinged. When this happens, the markets will adjust VIOLENTLY to the downside.

And smart investors will use it to make literal fortunes.

If you’re looking for a means to profit from this we’ve already alerted our Private Wealth Advisory subscribers to FIVE trades that will produce triple digit winners as the market plunges.

As I write this, ALL of them are up.

And we’re just getting started.

If you’d to join us, I strongly urge you to try out our weekly market advisory, Private Wealth Advisory.

Private Wealth Advisory uses stocks and ETFs to help individual investors profit from the markets.

Does it work?

Over the last two years, we’ve maintained a success rate of 86%, meaning we’ve made money on more than EIGHT out of every ten trades we make.

Yes, this includes all losers and every trade we make. If you followed our investment recommendations, you’d have beaten the market by a MASSIVE margin.

However, if you’d like to join us, you better move fast…

… because tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Click Here Now!!!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research