If you’ve been reading us for some time, you’ve probably wondered why the market keeps rallying no matter what.

Time and again, stocks start to breakdown and then suddenly BOOM they erupt higher. CNBC and other financial media outlets then trot out various narratives to explain the action.

“Stocks went up because the data was strong and the economy is improving!”

“Stocks went up because the data was weak and the Fed will have to intervene!”

These narratives, while amusing, are complete fiction.

Stocks are rallying due to abject intervention. That intervention is occurring when the Fed has one of its proxies (one of the TBTF banks) engage in obvious and clear manipulation.

Now, market manipulation is a normal facet of the world ever since the 1987 Crash forced Reagan to cerate the Plunge Protection Team.

The irony here is that the manipulation taking place in the market today is going to cause another 1987-type Crash.

It is employing the exact same computerized buying.

Here’s how this scam works.

One of the biggest investment fads today is a type of fund called risk-parity funds.

If you’re unfamiliar with risk-parity funds, they are meant to achieve “risk parity” for investors by buying or selling stocks and bonds based on the perceived risk in the markets via the VIX.

If the VIX is falling, meaning the perceived “risk” in the markets is falling, these funds sell bonds and buy stocks. If the VIX is rising, meaning the perceived “risk” in the markets is rising, these funds BUY bonds and SELL stocks.

The problem with all of this is that these actions are ENTIRELY based on algorithms, NOT human decision making. Put another way, whatever the VIX does, these funds will be buying or selling stocks and bonds without judgment.

All told there are over $400 BILLION allocated to these funds globally. So… if you want to force a stock market rally, all you need to do is push the VIX lower and BOOM! you’ve got $200 billion or so in buying pressure hitting the stock market.

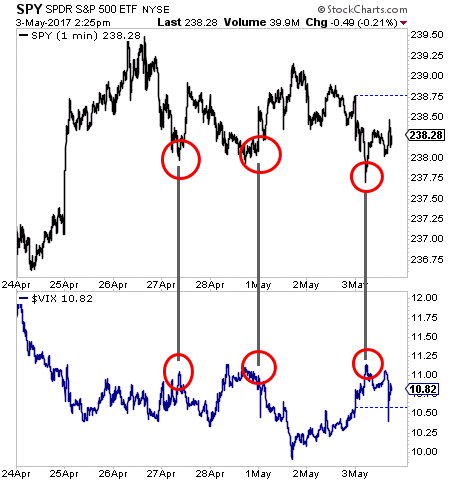

You can see this scam in the chart below: anytime stocks begin to break down, someone SLAMS the VIX lower. This is ridiculous because the VIX should be RISING when stocks are breaking down. Instead, it suddenly reverses for no reason leading to indiscriminate buying of stocks.

This is market rigging plain and simple. “Someone” (likely the Fed” is causing this to happen).

This rig, like all market rigs, will stop working. And when it does, some $400 billion in capital (not to mention the trillions of $’s worth of funds that have bought stocks based on this stupid scheme) will adjust leading to another 1987-type Crash.

This rig, like all market rigs, will stop working. And when it does, some $400 billion in capital (not to mention the trillions of $’s worth of funds that have bought stocks based on this stupid scheme) will adjust leading to another 1987-type Crash.

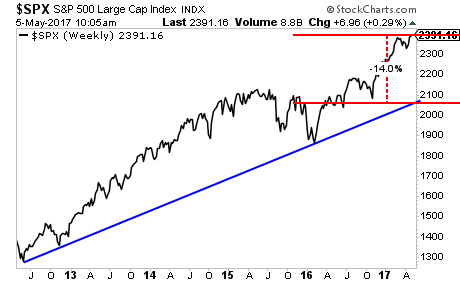

Here’s the market leading up to the 1987 Crash.

Here’s the market today.

The only reason stocks are not more extended is because unlike the late ’80s, the macro environment is weak. But the same issues of computerized buying and systemic risk are the same.

Fortunately there are ways to profit from this.

To pick up a FREE investment report outlining three investments that you could make you a ton of money when the markets collapse…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research