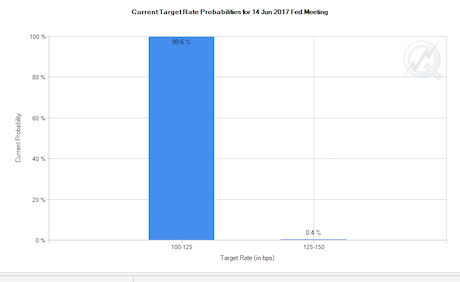

The Fed concludes its June meeting today. The Fed fund futures markets put the odds of the Fed hiking rates again at 99.6%.

This would mark the third rate hike by the Fed during this cycle.

Why would this matter?

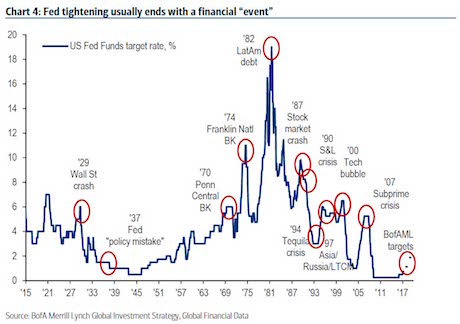

Because it indicates the Fed is embarked on a serious tightening cycle. One rate hike can be a fluke. Two rate hikes could even be just policy error. But three rate hikes means the Fed is determined.

As Bank of America noted in a recent research note, when the Fed becomes determined to tighten… it usually ends in an “event.”

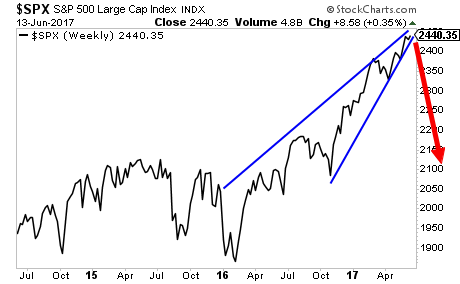

What would an “event” look like for today’s market?

A Crash is coming…

And smart investors will use it to make literal fortunes from it.

To pick up a FREE report outlining how to profit from the coming crash…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research