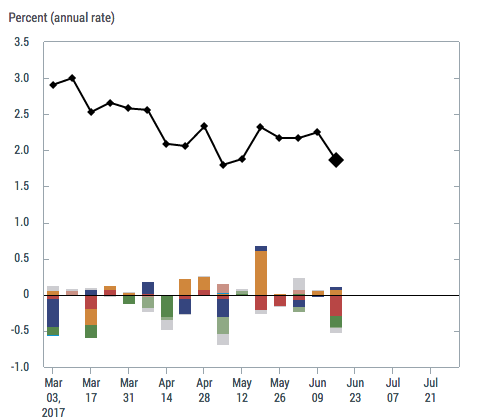

Last week the NY Fed downgraded its economic forecast for 2Q17 to just 1.9%. Even worse, it is now forecasting 2017 total growth to be a measly 1.5%.

Yes, 1.5%.

There is a clear trend to this chart… and it’s NOT up.

Source: NY Fed

Wait, it gets worse.

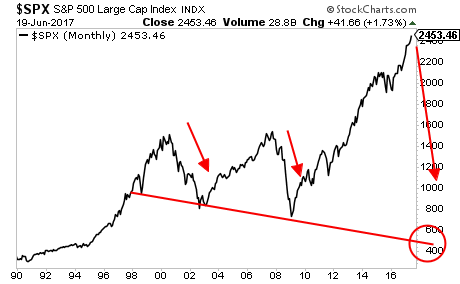

The Citi Surprise Index has collapsed to levels not seen since 2011.

Source: Yardeni Research

The last time this index was at these levels, the Fed was about to launch Operation Twist to provide additional liquidity to the markets.

Today, the Fed is about to start WITHDRAWING liquidity from the markets. And not a little: $10 billion per month this quarter, and $20 billion per month in 4Q17.

What’s the deal here?

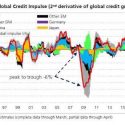

The Fed is “taking away the punchbowl” from the markets. Sure, stocks might hold up relatively well today or tomorrow, but the reality is that the $14 trillion market rig of the last seven years is ending. Globally Central Banks are going to begin withdrawing stimulus from the system, as global credit is already decelerating at a pace not seen since the Great Crisis.

A Crash is coming.

A Crash is coming.

And smart investors will use it to make literal fortunes from it.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 87 are left.

To pick up one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research