As we noted yesterday, the world’s Central Banks have begun sending signals that the price of money in the financial system (bond yields) is going to be rising.

Why is this a big deal?

Because globally the world has packed on $68 TRILLION in debt since 2007. And ALL of this was issued based on the assumption that bond yields would be remaining at or near record lows.

The bad news?

They’re not. Already we’re beginning to see bond yields RISE.

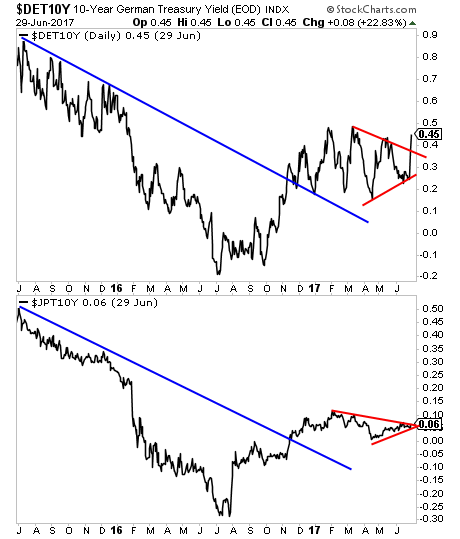

The yield on the 10-Year Treasury erupted above its long-term trendline in mid-2016. It has since consolidated and is now about to break out of a bullish falling wedge to new highs.

It’s not the only one.

The yields on 10-German Bunds and 10-Year Japanese Government Bonds are ALSO breaking out to the upside in a big way.

Put simply, rising bond yields is a GLOBAL phenomenon. And it spells DOOM for the world’s $217 TRILLION debt bubble.

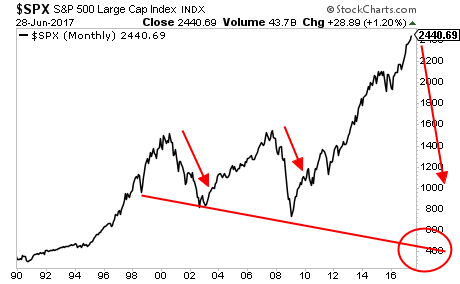

If you thought the 2007 Debt Bubble was bad… wait until you see what’s coming.

Here’s a hint…

A Crash is coming…

And smart investors will use it to make literal fortunes from it.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 47 are left.

To pick up one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research