The Fed keeps ringing bells to signal the top, but the markets aren’t listening.

Janet Yellen is set to present the Fed’s Monetary Report to Congress this week. Her remarks have already been posted online.

The results aren’t pretty.

Valuation pressures across a range of assets and several indicators of investor risk appetite have increased further since mid-February…

The Committee currently expects to begin implementing the balance sheet normalization program this year provided that the economy evolves broadly as anticipated…

Source: Federal Reserve

Firstly, Yellen is CLEARLY warning that the Fed sees bubbles in the system. For a Fed Chair to specifically cite “valuation pressures” in the markets is simply incredible… particularly when you consider that the Fed has been actively propping up stocks for the better part of eight years.

Secondly, Yellen reiterates the Fed’s intention to begin normalizing its balance sheet this year. This is an absolute game changer for the markets as it marks the first time in a DECADE that that FEd will be actively withdrawing liquidity from the system.

What does all of this mean?

The Fed is getting ready to pull the plug on the markets.

What does that mean for stocks?

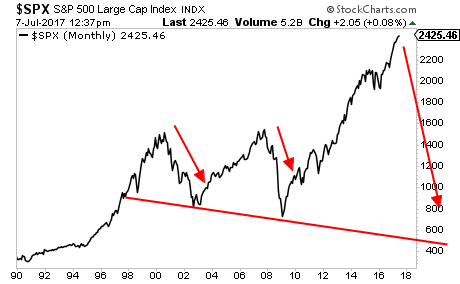

We’re going to have the 3rd and worst crisis in 20 years.

A Crash is coming…

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 29 are left.

To pick up one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research