A reader recently wrote in asking why I’m so bearish.

I want to be clear; I’m not bearish because of the economy, nor because of stocks trading at bubble-level valuations (though both of those issues concern me).

I’m most bearish because of the ongoing market rig that is setting the stage for a massive 1987-type crash.

I’m talking about the VIX-manipulation/ risk-parity fund algorithms.

I realize this probably sounds like mumbo jumbo, so let me explain.

The VIX is a volatility index, specifically an index showing the price investors are willing to pay for protection against volatility.

When the VIX rises, it signals investors are getting concerned. When it falls, it signals investors are getting complacent.

At least, that’s how it’s supposed to work.

The problem with this is that an entire fund industry has been created based on how the VIX trades. These funds are called Risk Parity Funds. And they are meant to balance an investor’s exposure to stocks and bonds based on… market volatility via the VIX.

If market volatility is rising, these funds buy bonds (a safe haven). If market volatility is falling, these funds buy stocks.

Put simply, these funds buy and sell stocks based on how the VIX is trading.

The process is entirely automated: they do this based on algorithms, NOT human beings watching the VIX and then hitting “buy” or “sell.”

Worst of all, this is not a small industry. Risk Parity funds manage some $500 BILLION in assets.

So where is the market rig?

The market rig concerns the fact that “someone” is routinely pushing the VIX lower because it induces Risk Parity Funds to buy stocks.

This rig has gotten so obvious that it is now happening at the same time every day: in the 9:50AM-10:00AM window.

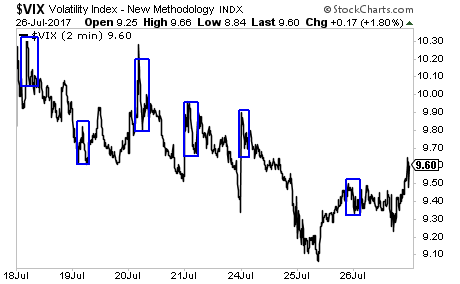

You can see it in the chart below, which I showed clients last week. Every single day, someone slams the VIX lower at this time. They also do this throughout the day whenever stocks are close to breaking down.

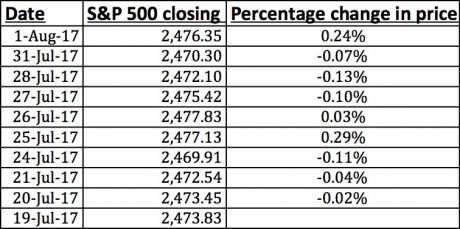

If you think I’m creating a conspiracy theory here, take a look at the market’s close of the last 10 days: the S&P 500 is moving less than a quarter of a percent every single day. “Someone” is literally PINNING the market, holding it in place.

And they are doing this by slamming the VIX lower to force Risk-Parity Funds to buy stocks ANY TIME THE MARKET BEGINS TO BREAK DOWN.

This is a market rig, plain and simple. It is astonishing that it has gotten this bad. But it is so obvious that even a child could catch it.

So why am I bearish?

Because all market rigs break eventually. This one will be no different. And when it breaks, the VIX will spike, and those same Risk Parity Funds will sell stocks indiscriminately, just as they’ve been buying them for weeks now.

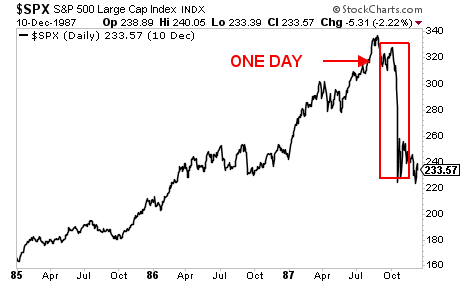

This will cause a Market Crash. And it won’t be a “grinding lower for months roller coaster” type Crash like the one in 2008. It will be a “one day implosion” Crash like that of October 1987.

Indeed, this is precisely the same scenario that lead up to the ‘87 Crash: automated programs buying and selling stocks based on various metrics. It worked great when the market was rallying. But once it broke down… this happened.

That’s why I’m bearish. It isn’t because of the economy or stock valuations… it’s because the market is being rigged. And when this rig breaks it will be a disaster.

A Crash is coming…

And smart investors will use it to make literal fortunes.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

Today is the last day this report is available to the general public.

To pick up one of the last remaining copies…

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research