The US Dollar collapse keeps driving the markets.

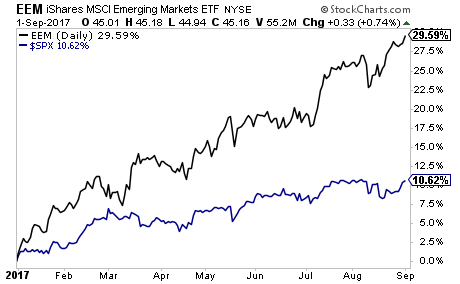

Thus far in 2017, Emerging Markets have outperformed the US stock market by a wide margin. We keep hearing about how the US stock market is like a raging bull. But Emerging Market stocks have outperformed US stocks by nearly 200%.

A big reason for this?

The US Dollar collapse.

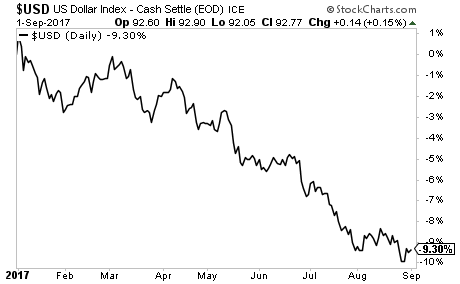

As we write this, the US Dollar collapse is over 9% year to date. This benefits Emerging Market companies which by and large issue their debts in $USD. Put another way, a US Dollar collapse is like a virtual debt write-off for any corporation outside the developed world.

However, the implications of a US Dollar collapse extend far beyond Emerging Markets. Indeed, as we’ve noted, this is THE BIGGEST TREND OF 2017. And those investors who have taken note of it have already profited handsomely.

Indeed, the biggest money is made when you identify a major trend and get in early.

In early 2017, we forecast to our clients that the $USD would be collapsing this year. At that time the financial media was rife with “gurus” talking about how the $USD was going to roar higher. Indeed we repeatedly read that “2017 was going to be he year of the $USD.”

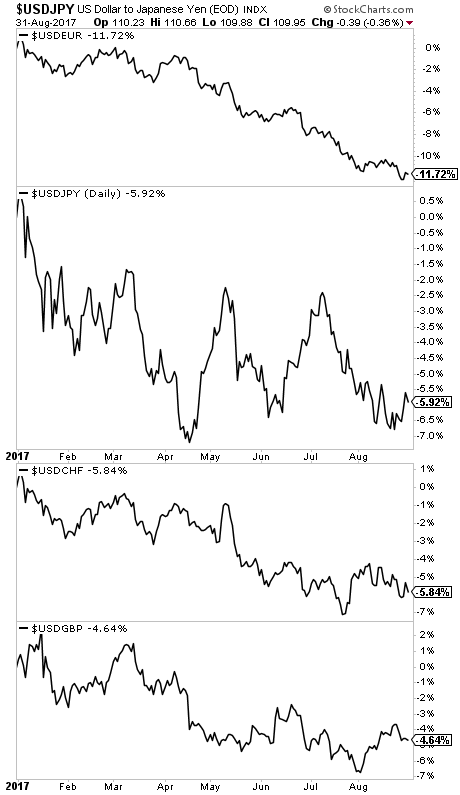

Since that time the $USD has dropped like a brick against every major world currency.

Smart investors will use this trend to make literal fortunes.

If you’re not taking steps to actively profit from this, it’s time to get a move on.

We just published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

We are giving away just 100 copies for FREE to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/goldmountain.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research