The Fed is dramatically understating real inflation.

As you know, I’ve been very critical of the Fed’s inflation measures for years. The official inflation measure (Consumer Price Index or CPI) does a horrible job of measuring the actual cost of living for Americans.

I have long stated that this is intentional as the purpose of CPI is to hide the true rate of inflation so the Fed can paper over the decline in living standards that has plagued the US for the last few decades.

The Fed isn’t doing this out of ignorance, either. Back in 2002, Fed researchers actually reviewed the usefulness of its CPI metric for forecasting inflation.

The results were not pretty. In fact, the Fed discovered that its official measures of inflation (CPI and PCE) do a horrible job of predicting future inflation.

So what does predict future inflation accurately?

FOOD prices.

We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…

Source: The Regional Economist

I want you to focus on these two admissions:

1) The Fed has admitted that its official inflation measures do not accurately predict future inflation.

2) The Fed admitted that FOOD prices are a much better predictor of future inflation. In fact food prices were a better predictor of inflation than the Fed’s PCE, non-durables goods, transportation services, housing, clothing, energy and more.

Put simply, if you want to predict inflation well… you NEED to look at food prices.

—————————————————————-

Are You Ready For the Next Crisis?

The markets are in a massive bubble. And when it bursts, it’s going to make smart traders very, very RICH.

Our specially designed options service The Crisis Trader is already up 37% this year, and that’s BEFORE the Crash hits.

Yes, 37%. And we’ve still got FOUR months to go this year!

Normally a service like this costs $5,000 just to try…

But you can get FOUR of The Crisis Trader’s high octane options trades for just $0.99 today.

This offer expires tonight at midnight.

—————————————————————-

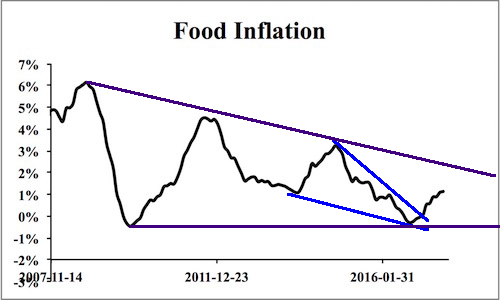

With that in mind, food inflation is on the rise. As a whole, Food and Beverage inflation has broken out of a descending wedge pattern (blue lines) in the context of a massive wedge triangle pattern (purples lines). We’re heading for a test of the upper purple line shortly.

Put simply, inflation is rising. And at it is going to be getting worse in the weeks and months ahead. Why do you think the $USD has dumped 10% this year already?

This is THE BIG MONEY trend today. And smart investors will use it to generate literal fortunes.

We just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead

The report is titled Survive the Inflationary Storm. And it explains in very simply terms how to make inflation PAY YOU.

We are making just 100 copies available to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/inflationstorm.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research