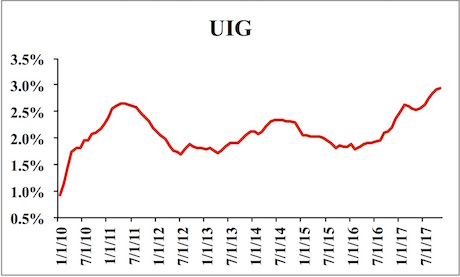

While the Fed Board of Governors continues with its “we don’t see inflation anywhere” shtick, one of its own in-house measures (the underlying inflation gauge or UIG) is about to hit 3%.

The UIG estimated on the “full data set” increased from a revised 2.91% in October to 2.95% in November.

Source: the NY Fed.

Yes, one of the Fed’s OWN inflation measures (and one that leads the CPI) is about to hit 3%. And by the way, the UIG is from the NY-Fed: the regional Fed bank involved in daily market operations with the best understanding of how the financial system actually works.

Why does this matter?

Because, as I outlined in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, since the mid-1990s, the Fed has embarked on a policy of intentionally creating asset bubbles to keep the financial system afloat.

In the late ‘90s we had the Tech Bubble or bubble in Technology stocks.

When that bubble burst in 2000, the Fed dealt with it by intentionally creating a bubble in housing: a more senior asset class that was more systemically important.

When that bubble burst in 2008, triggering the Great Financial Crisis, the Fed dealt with it by intentionally creating yet another bubble…

… this time in US sovereign bonds, also called Treasuries.

By the way, these bonds are THE most senior asset class in the US financial system. The yields on these bonds represent the “risk-free” rate against which EVERY asset class in the financial system is priced.

So when these bonds went into a bubble, EVERYTHING followed.

This is THE endgame for Central Bank policy. And the bad news is that inflation is what will lead to this bubble bursting.

You see, bond yields track inflation (as well as economic growth). So as inflation rises (again, the UIG is clocking in at 3% already, bond yields will rise.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research