The bond market is talking, but no one is listening.

As I explain in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, the yield on the 10-Year US Treasury bond is the single most important interest rate in the financial system.

This is the “risk free” rate of return… the rate against which ALL risk is measured (stocks, commodities, corporate bonds, mortgages, etc).

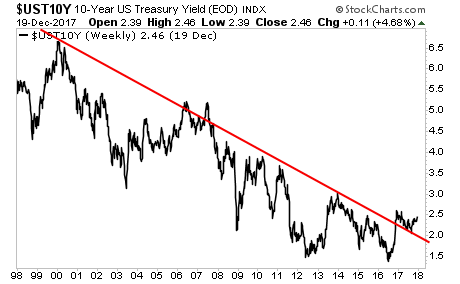

With that in mind, take a look at the following chart.

As you can see, the yield on the 10-Year Treasury is breaking out to the upside, having broken above its 20-year trendline.

Why does this matter?

Because this chart is telling us, in no uncertain terms, that inflation is coming.

You see, bond yields track inflation (as well as economic growth). So as inflation rises, bond yields will also rise.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

It will take time for this to unfold, but as I recently told clients of my Private Wealth Advisory report, we’re currently in “late 2007” for the coming crisis.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research