It is clear stocks are in a massive bubble based on their Price to Sale (P/S valuation).

What about the economy?

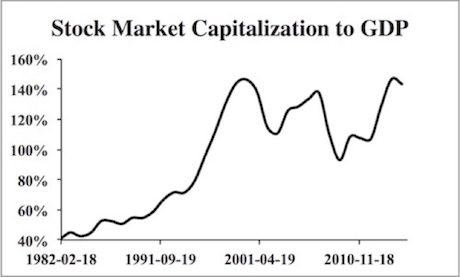

Warren Buffett once famously stated that his favorite means of valuing stock was the stock market capitalization to GDP ratio.

Below is a chart for this metric. As you can see, the stock market today is as overvalued relative to the economy as it was at the peak of the 1999 Tech Mania.

So stocks are overvalued based on the most reliable corporate data point (revenues) and they are also overvalued relative to the economy. Scratch that, they’re not overvalued… they’re trading at 1999-Tech Bubble insanity levels.

We all remember what came after that…

What’s coming will take time for this to unfold, but as I recently told clients of my Private Wealth Advisory report, we’re currently in “late 2007” for the coming crisis. However, there is one main difference between 1999 and today…

Namely, that the Fed has been INTENTIONALLY creating bubbles for nearly 20 years today… and it’s out of more senior asset classes to use!

Let me explain…

The late ‘90s was the Tech Bubble.

When that burst in the mid-‘00s, the Fed created a bubble in housing.

When that burst in ’08 the Fed created a bubble in US sovereign bonds or Treasuries.

And because these bonds are the bedrock of the US financial system, the “risk-free rate” of return against which ALL risk assets are valued, when the Fed did this it created a bubble in EVERYTHING (hence our coining of the term “The Everything Bubble” and our bestselling book by the same name).

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research