The global economy is SCREAMING that inflation is coming.

Factories across the globe warned they are finding it increasingly hard to keep up with demand, potentially forcing them to raise prices as the world economy looks set to enjoy its strongest year since 2011.

Source: Bloomberg.

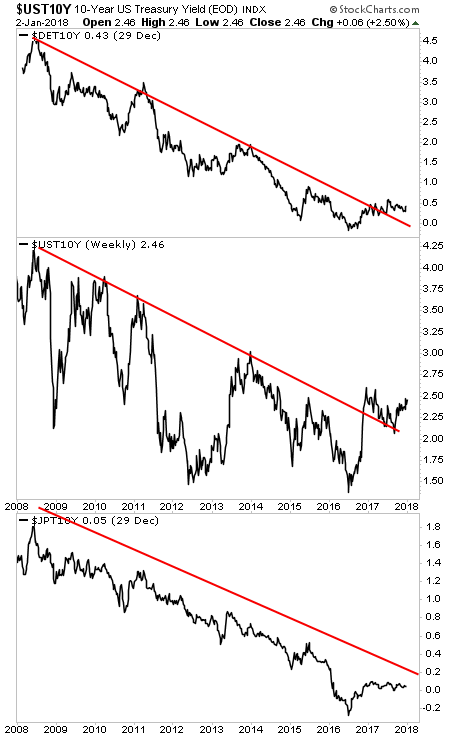

By the way, 2011 was the year of the last inflationary shock. And by the look of things, 2018 is going to be the next one. Already global bonds are selling off, with yields on German 10 Year Bunds, 10-Year US Treasuries, and 10-Year Japanese Government Bonds breaking out of historic downtrends.

Put simply, starting in June of 2017, the markets began to adjust to the fact that BIG inflation was on the rise.

Why does this matter?

As I explain in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, US sovereign bonds (also called Treasuries) trade based on inflation expectations.

Put simply, when inflation spikes higher, so do Treasury bond yields.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

And when the Everything Bubble bursts, the Fed will be forced to engage in truly EXTREME monetary policy as it attempts to RE-flate this bubble in bonds.

What’s coming will take time for this to unfold, but as I recently told clients, we’re currently in “late 2007” for the coming crisis. The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research